"吾不敢為主,而為客﹔ 不敢進寸,而退尺."

“When I am not ready to advance an inch, I will retreat a foot.”

Lao Tzu - ancient Chinese philosopher, 531 BC

Contact Us:

For any enquiry, do send us an email: enquiry@macrowatersasia.com

248 Tung Hip Commercial Building, 6/F Room 601 Des Voeux Rd, Central Hong Kong.

Our firm is SFC licensed Type 9 (BLG329) and U.S NFA registered (CTA - Commodity Trading Advisor 0535513).

Besides Multi-Strategy-Multi-season (ms2) hedge fund structure, we can run customized Managed Futures U.S 'CTA style' on global equity index, commodities, bond and currency futures to diversify via non-correlated assets and mitigate downside risks for those equity or bond only investors portfolios.

Global macro and CTA investing have proven over decades to be most "consistent and resilient" in good & bad times. Hence, our Multi-Assets style if expressed as an equation, Consistent alpha generation, C = ms².

In addition, our bespoke "Anti-inflation" solution can help to hedge rising food, energy, clothing and utility prices due to current inflationary environment that will erode a company's net profits.

ESG or Sustainability is another focus area in our DNA and would serve to promote the brand reputation of both listed and private companies to enhance society and the environment.

We are always on lookout for new talents around the globe to build our team and competitive-edge to achieve our mission of innovation for all investors and be the best we can be.

For potential investors, feel free to drop us a note but we can only accept Professional Investors / Accredited Investors / Qualified Purchasers (endowments, foundations, pension, corporations, family offices & ultra high net-worth investors).

Our monthly newsletters and track record - model portfolio are available upon request only. Some snapshots are found in our 'Competitive-Edge' section and on request.

About Us:

A team of passionate & unconventional investment professionals with over 30 years experience dedicated to managing money prudently by solving global macro puzzles using both 'Art & Science' and relatively low leverage.

Both contrarian & trend-following at the right time of the cycle - always anticipating but never predicting based on scenario analysis that can evolve over time. Predictions run on premise of fixed notions of analysis whereas anticipating involves dynamic analysis & adapting to new conditions - like water that flows never go stale.

More importantly, the balance or harmony of yin/yang in the universe & the markets should not be underestimated and our own judgement not overestimated.

Fundamental and technical analysis skills are basic requirements besides understanding economics and business. Our X-factor is integrating this with politics, history and philosophy to get better views of the macro environment.

Our open, diverse culture & teamwork utilizes complementary skillsets to prevent 'groupthink' and filter out bad trades ideas. Over time, we like to incorporate good quantitative methods with super-fast computers to enhance our analysis and execution but retain the human creativity to find better innovative ways.

We seek to find an answer and solution to a basic question:

Is there a way of investing to prevent losses in a bear market and profit from both bull (economic growth) and bear (economic recessions) markets?

This is a question that many investors over decades are trying to answer. Against prevailing wisdom, the answer is yes.

It is the Global Macro strategy & absolute return - able to long/short in all asset classes in a highly tactical manner with high risk controls. Main drawback of macro-trading is performance tend to lag the 100% long only funds in a strong bull market. Obviously, not all macro funds can do as well in all situations.

We know it is not a perfect answer like all solutions, but it diversify risks by more than 50% (from investing in stocks only) and has reasonably good track record over last 40 years especially in times of crisis (evidence available upon request).

A lesser known fact is institutions like endowments, foundations, family office and pension funds had invested in macro funds over the last few decades for risk mitigation & consistent performance.

Our Goals:

Ultimately, we provide a unique differentiated solution that aim to protect capital and grow at attractive risk-adjusted returns consistently and with limited downside in 'both bull & bear markets'.

People and good systems are key; investors needs may vary and we are happy to discuss a spectrum of solutions and customize suitable solutions for everyone as best as we can.

The unique position for us is to attempt to stay resilient in market downtrends as we learn and grow as a firm over time to know 'there is a way' to survive and thrive over time. This is why we live by our golden rule: "Anticipate" not react to market events. Also, stick to our PGA motto - Preserve*Grow*Adapt.

Our Milestones:

Sep 2016: The firm begins

Feb 2017: Participant in New York EM Pension Fund conference

Jan 2018: Offshore Cayman Fund

Aug 2018: SFC licensed Type 9 (Asset Management)

Dec 2018: US SEC license ERA (Exempt Reporting Adviser) & registered with Cayman Islands Monetary Authority

Dec 2018: 1st Cayman fund launch of US$25mil (global macro)

Mar 2020: US NFA (National Futures Association) registered as CTA (Commodity Trading Adviser)

Dec 2021: 2nd Cayman fund launch (Multi-Strategy) & CTA ("Anti-Inflation" hedging)

Ongoing - financial risk advisory for HNWI/firms looking to restructure their portfolios, recovery from bad investments, maximize excess cash reserves, inflation hedging solutions, strategic M&A connections , ESG strategic investing & value creation using disruptive technologies.

Markets are as old as the hills:

Time has not changed over eternity, only devices to tell time have. Similarly, financial markets have not changed over time, only instruments to invest have.

We want to uncover the 'fundamental truths of investing' - demand & supply, fear & greed, booms & busts, inflations & deflations, economic growth & contractions, corporate innovation & obsolescence.

Thus, our competitive-edge & investment philosophy gives us a robust & independent framework for better analysis & decision-making on the market truth & reality; not tied to earning sales commissions at the expense of clients/investors.

In addition, the humility to admit and rectify mistakes early, ability to recognize the complexity of market risks and the need to adapt via continual learning are keys to long-term success. It is important we build a learning organization to learn from mistakes and find new solutions constantly.

Below are some examples of interesting clocks over centuries using various methods to tell time:

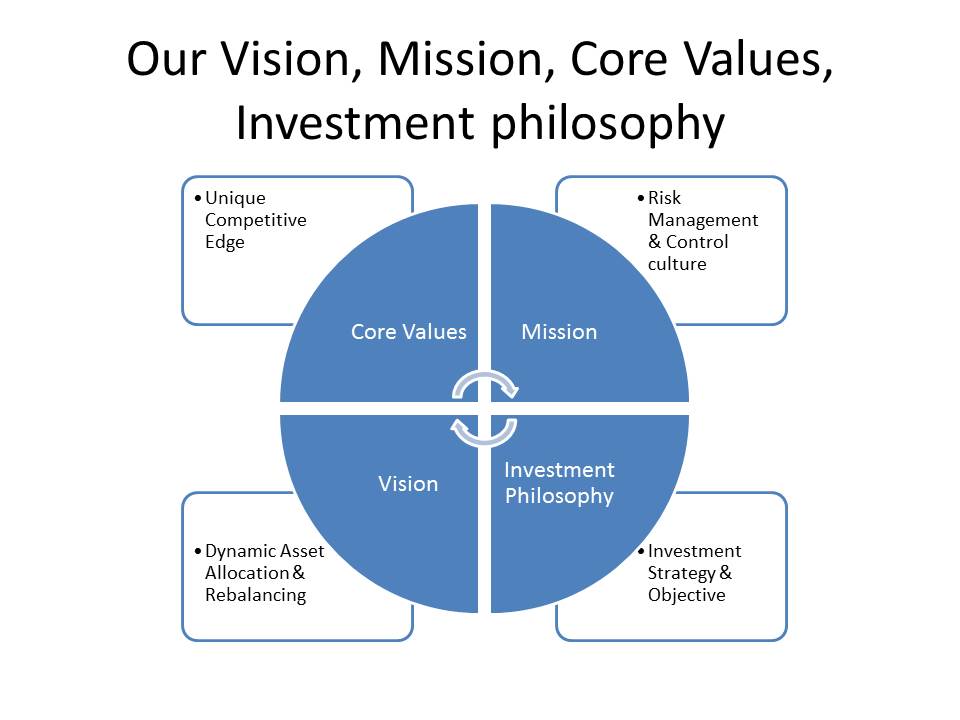

Our Core Values:

HUMILITY - Reflect & learn from mistakes and those better than us.

INNOVATION - We think different to create better solutions.

PERSEVERANCE - Persist with resilience when others give up as things get hard.

ADAPTABILITY - Flow like water but yet agile and resourceful.

INTEGRITY - Reputation is priceless that money cannot buy.

RESPONSIBILITY - Keep our commitments to clients, employees, society and the environment.

HIP-AIR: Hip denotes 'trendy & advanced' and Air denotes 'take off or fly'. Our core values help us to adapt and stay with new trends to succeed for our clients.

"Success of our Investors is our success."

Our Mission:

Making Innovative Investments for Investors (MIIFI).

Protect & Grow our client's capital by being adaptable, agile and resourceful.

Our Vision:

To build the most resilient & advanced alternative investment firm managing capital for good causes in bull & bear markets.

To disrupt and create a viable alternative to "Blackrocks of the world" and educate & assist a larger pool of investors.

To realize the vision, we focus on our core values, mission & investment process.

Our Investment Process:

Preserve*Grow*Adapt (PGA)

Proprietary '5x20' Dynamic Multi-Asset Allocation model to ride 'Boom & Bust' market cycles

ESG and SRI:

We believe in Environment, Social & Governance, ESG & Social Responsible Investing, SRI as per guidelines by UN and being an early believer of 'Go Green' of the 80-90's era. Green technologies, AI & IOT applications, Biotech & Biomedical innovations are key areas we are highly interested in as they are the future of the world.

The future plan is to run a bespoke ESG funds (secondary and VC) for corporations that are both private and public listed due to ESG ratings becoming the standard yardstick on stock exchanges and maintain global brand equity & reputation.

New project to run an AI/Fintech to help global retail investors - retirees and Millennials invest better and smarter using machine learning/big data technology.

Asian-U.S focus:

We are a Multi-Asset specialist in both US and Asia markets such that both sides can mutually diversify into less correlated income streams to reduce risk and not sacrificing returns.

Future plans to expand internationally are in line with our perspective that Asia-China growth will become the fastest outside U.S.

We are open to international strategic partners that have high synergy levels and share common goals to achieve the long-term vision of being a leading niche alternative investment firm. But, if we cannot find suitable ones, we rather grow organically via disruptive strategy and hiring suitable & dedicated talents.

Professional Service Providers:

We use reputable and international service providers like audit firm, fund administrator, law firm and banks to meet the highest standards of regulatory and corporate governance.

Using reputable independent fund administrators that are external to our firm is key to protecting investors such that greater investor confidence and being 'on the same boat' is not just another marketing spin but truly align the shared interests of mutual respect.

We take the trust and relationship with our investors very seriously because it is a rare mutually beneficial connection that goes on for the long-term. It is almost like having the stars align.

Our "Job to be done" is simply to help our clients - "Protect capital and grow it to beat annual inflation rate & cost of living regardless of market cycles or seasons".

For private & public companies, we help with our bespoke "Anti-Inflation and ESG/Sustainability" Solutions as the "Jobs to be done" are reduce business costs, meet global corporate governance regulations & help solve the climate crisis.

关于我们:

拥有超过30年经验的热情和非常规投资专业人员团队致力于通过使用“艺术与科学”和低杠杆解决全球宏观难题,审慎地管理货币。 基础和技术分析技能是除了了解经济和业务之外的基本要求。我们的X因子正在将这与政治,历史和哲学相结合,以获得更好的宏观环境。 我们开放,多元化的文化和团队合作利用互补的技能,防止“集体思考”和过滤掉坏的交易想法。(我们是香港证监会第9类持牌公司及美国证券交易委员会注册豁免申报顾问)

我们寻求一个重要问题的答案和解决方案:

有没有一种投资方式来防止熊市的损失和来自牛市(经济增长)和熊市(经济衰退)的利润?

这是一个问题,许多投资者几十年来试图回答。反对普遍的智慧,答案是肯定的。这是全球宏观战略。

我们知道这不是一个完美的答案像所有的解决方案,但在过去40年,尤其是在危机时期(经验证据可应要求提供)有相当好的记录。

一个鲜为人知的事实是,像禀赋,基金会,家庭办公室和养老基金这样的机构

我们的目标:

最终,我们提供了一个独特的差异化解决方案,旨在保护资本并持续增加风险调整后的收益,同时在“牛市和熊市”都有有限的下行空间。 这是一个利基地区,传统投资不能填补,因为市场下跌导致投资者的损失。这是我们喜欢的投资者的一个教育领域,“有一条路”。

我们的任务:

帮助禀赋,基金会,养老金,公司和高净值投资者保护和增长他们的财富随着时间的推移,创造一个良性循环,增加价值的正反馈循环。 我们相信,当这些机构和个人随着时间增长资本时,财富效应将导致改善的医疗保健,更好的教育和赋予社会权力。

我们的核心价值观:

互惠互利,诚信卓越,亚洲价值观和哲

我们的愿景:

建立最具弹性和社会责任的替代投资公司,管理牛市和熊市的良好原因基金。通过卓越的做法,我们可以回馈社会,使世界变得更美好。

社会责任感:

我们相信“社会责任投资”按照联合国的指导方针。绿色技术,生物技术和生物

亚洲数据透视:

未来计划扩展到韩国和新加坡符合我们的替代投资愿景的亚洲枢纽,亚洲 - 中国的增长将成为世界上最快的。

专业服务提供商:

我们得到了“四大”国际审计公司,着名的基金管理公司,律师事务所和银行的支持,以满足监管和公司治理的最高标准。

Disclaimer: All information is strictly for Professional Investors and not meant to be a sale, advice or marketing of any product or service. No information here is allowed to be duplicated nor forwarded and belong to Macrowaters Asia Fund Management. We will not hesitate to take legal action according to copyright laws. All charts and performance metrics (gross returns before fees) are based on our actual model portfolio for illustration and not indicative of future performance. Past performance does not guarantee nor indicate future performance. Investment in financial markets involves all kinds of risks and may result in losses.

关于我们

“吾不敢为主,而为客;不敢进寸,而退尺。"

老子 - 古代中国哲学家,公元前531年

联系我们:

对于所有查询,请给我们发电子邮件:enquiry@macrowatersasia.com 我们一直在寻找全球新的人才来建立我们的团队和竞争优势。我们在香港的办公地址将很快更新。 对于潜在投资者,欢迎所有查询,但必须符合专业投资者/认可投资者指南。 我们的季度通讯和追踪记录 - 模型组合.

市场和山丘一样古老:

时间没有改变永恒,只有设备告诉时间有。同样,金融市场也没有随时间变化,只有投资的工具。 我们想要揭开“投资的基本真理” - 需求和供应,恐惧和贪婪,繁荣和萧条,经济增长和收缩,企业创新和过时。 因此,我们的竞争优势和投资理念为我们提供了一个强大的框架,更好的分析和决策。此外,早期承认和纠正错误的谦卑,识别市场风险的复杂性的能力以及通过持续学习适应的需要是长期成功的关键。

以下是几个世纪以来使用各种方法来说: