'One can sum up all this by saying that the criterion of the scientific status of a theory is its falsifiability, or refutability, or testability.'

Sir Karl Popper, Austrian-British philosopher & professor, 1902

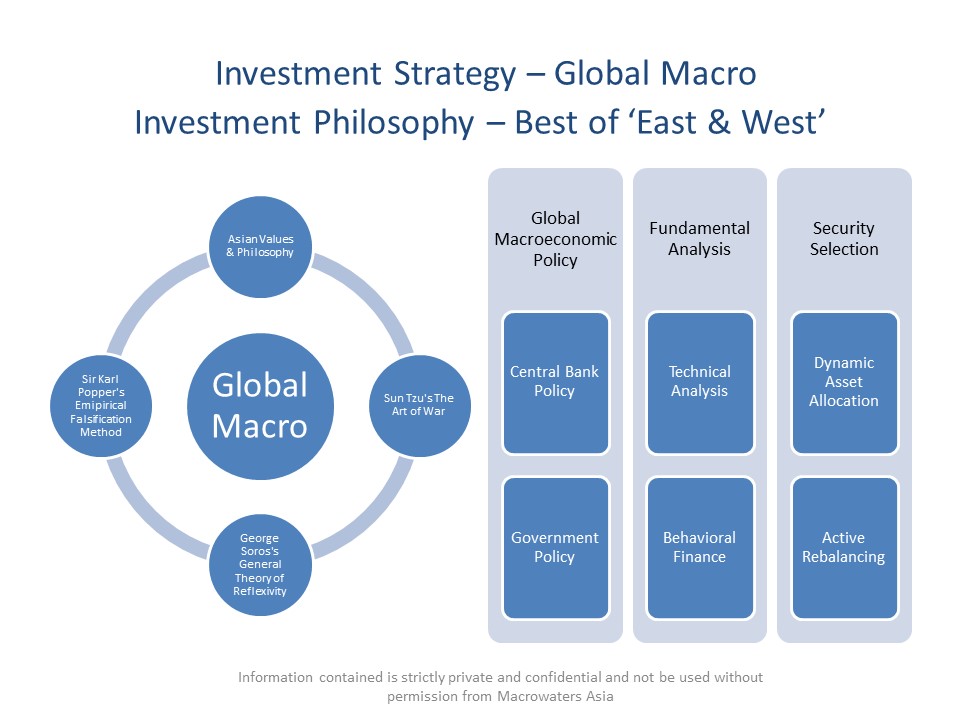

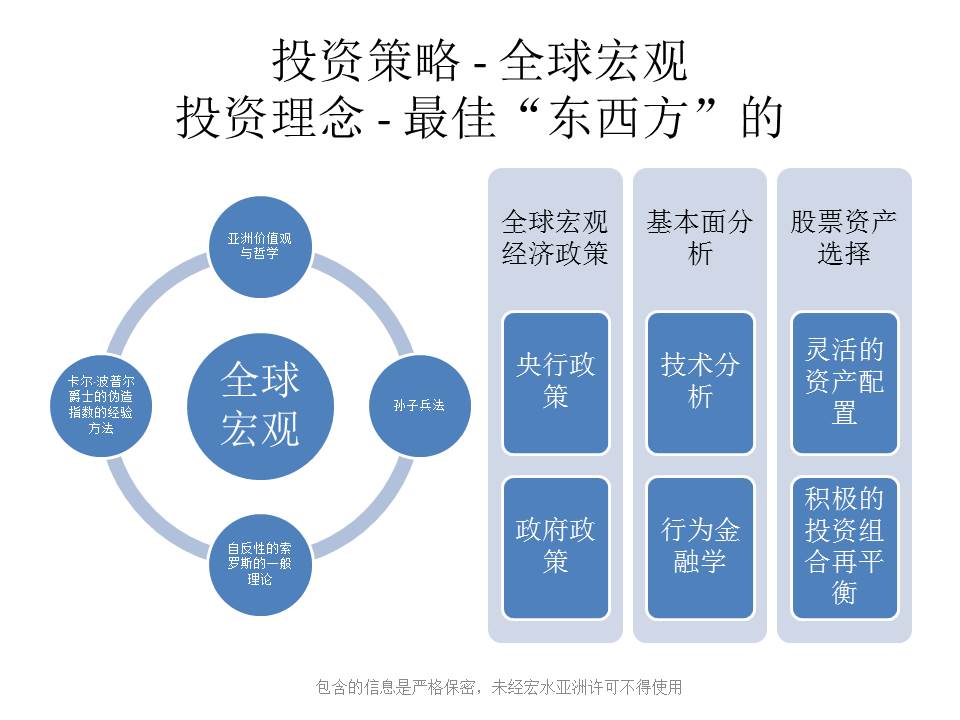

Our competitive-edge lies in our unique investment philosophy that is more robust than economic models or stand-alone strategies. As Karl Popper wisely said above, any theory that is sound must be able to withstand the test of falsification. One failed test is enough to prove its fallacy regardless of the number of confirmations previously.

The overlay of our investment philosophy with Multi-Strategy (global macro/CTA, long-short global equity, value & event driven) Investing deeply enhances our investment analysis and decision-making. This is what makes us different from the 'crowd'. This gives us an edge, not only to outperform, but also protect our downside risk. By anticipating trends that are bullish or bearish early, we minimize risks and capture alpha returns that we can lock in when markets go into euphoric bubbles or panic crashes.

Both bull and bear markets are conditions that we maintain our composure steady and systematically manage our portfolio to avoid risks and major market corrections. The Art of War by Sun Tzu, The Tao Te Ching by Lao Tzu and Confucian philosophy help us to build dynamic frameworks to defend and attack at appropriate times in the financial battle field. Numerous military & business leaders in the past have tested the Art of War and its efficacy. We can buy 'put options' and short via futures to hedge our portfolio against impending recessions, 'black swan' events and market downturns that traditional investments can't.

Dynamic Asset Allocation helps us reduce risks, capture start of new trends and exit old ones. Having an initial balanced stance of 20% in 5 Asset Classes of Currencies, Equities, Bonds, Commodities and Cash. We can dynamically shift via active rebalancing on a quarterly or monthly basis according to changing market environment to avoid risky overvalued assets. We look forward to add unique systematic strategies to enhance our investment process and competitive edge.

Sustainability of the competitive advantage is our key concern. Can this be repeated in a consistent non-emotional manner? Our answer is yes, because any investment strategy today need a multi-faceted lens to be consistent using macro-economics with inputs from history, philosophy and psychology. As financial markets are more than economics and finance, making risk hard to quantify, our emphasis on our unique Investment philosophy connects with market sentiment closely. This allows us to detect positive or negative feedback loops in market prices that are near or far from equilibrium & reality.

OUR GOLDEN RULE: "ANTICIPATE" NOT REACT TO MARKET EVENTS.

===============================================================================================================

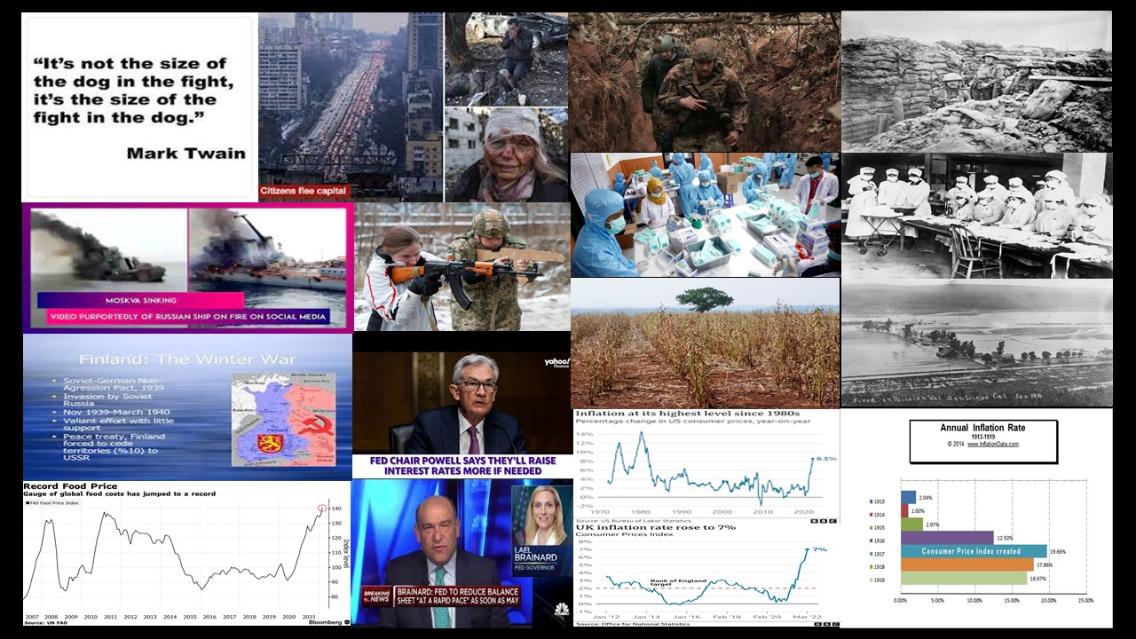

4 Mar 2022 market newsletter: 'War + Inflation = Fear’, World stands with Ukraine."

“If you lay siege to a town, you will exhaust your strength.”

Sun Tzu, Art of War ancient Chinese philosopher

High inflation just got hotter just as climate change worsen and with a Russian invasion of Ukraine on Feb 24 that took the media by storm and after 4 days of slow progress by Russian forces, Putin decided to put the world on high alert with ‘nuclear deterrent’ force. This is quite like the Cuban missile crisis in 1962 when J.F Kennedy managed to defuse with an agreement with Nikita Khrushchev to remove missiles from Turkey and Russia to remove them from Cuba (That was a Chinese ‘Tiger’ year like 2022)

As the quote above by ancient Chinese strategist Sun Tzu on the disadvantage of ‘laying siege to a city’ which Russia had done and puts itself at risk of failing as the world is with Ukraine and against any violence especially unprovoked.

We will see if this turns out true in coming weeks. But the market sentiment turned negative as fear has gripped investors as high inflation data and war in Ukraine that disrupts supply chains. Also, in Art of War, Sun Tzu said: ‘When you engage in actual fighting, if victory is long in coming, then men’s weapons will grow dull and their ardor will be damped.’

We wrote in our last month’s market report while being generally bullish despite inflation, warned of a ‘black swan risk – military conflict that add fuel to high inflation and oil’:

“The ‘black swan’ event is a military conflict or major political event that disrupts supply chains which in turn raise inflation and oil prices, leading to a sharp fall in business and consumer confidence. The risks are low but if it occurs, a market correction to 3984 support level (20% pullback) would be likely.”

-

ESG investing has gotten more important as the recent IPCC report showed the environment got worse than expected and the Ukraine war resulted in many well know companies ceasing to do business in Russia. The social and governance part of ESG is just as important as the E, Environment.

-

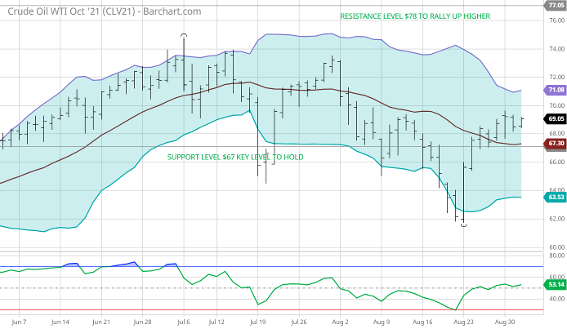

As we had mentioned in last month’s report, oil prices trending from $88 – 110 is likely as rise in supply is not enough. “OPEC+ on a gradual increase in output would not help as previously agreed 400,000 barrels in March may be insufficient to stop the rally especially as geo-political tensions in Ukraine-Russia and Middle-east exist.” output. The US-Iranian deal will help to increase output of 1.3mil barrels a day and together with US’s SPR (Strategic Petroleum Reserve) and European Allies to release 60mil barrels, it could create a “psychological effect” of higher supply and result in oil prices falling back to mid $80s. It is in the interest of the free World for oil price to fall as Putin’s regime benefit from it. Commodity feedback loops that drive prices higher via fundamentals & sentiment are interlinked. The “classic cure for higher prices is higher prices”.

-

Federal Reserve Chairman Powell on Mar 2: “Russia-Ukraine war has injected uncertainty into the outlook. Powell said he sees a series of quarter-percentage-point increases coming, though he left open the possibility of moving more aggressively should inflation persist.”

- As such, it is good to keep positive and stay bullish in the mid-term as the war may be toned down over time and the inflation rate slowed down by Fed rate hikes and supply chain improvements over the year. Otherwise, there are companies like Molson Coors, 3rd largest brewer in the world revealed their robust hedging strategy to counter inflation and raw material rising costs.

- With a war crisis, alternative assets like currencies and commodities are ideal to reduce risks. US Dollar’s bullish trend has gotten an extra boost. That would be a place to diversify money to instead of just keeping heavily weighted equity portfolios that most people rely on. Grains, metals, soft and energy commodities are in strong trends as we seen since last year and an ‘out of the box’ method to capture alpha returns and hedge inflation for companies. Most traditional fund managers are not well verse in this unfortunately, hence most clients have little exposure in commodities or hedges on down markets.

- In a war-inflicted market, the best course of action is to be neutral and slightly bearish with hedges on as the financial markets loses confidence the longer it drags on and energy prices spikes higher. The few sectors like defence, consumer staples and utility stocks may be possible places to look at i.e Tyson, TAP, ADM, RTX

- As a matter of defense, we had 2 bearish short-sell hedge in our Feb 3 market report: MCD and YUMC due to rising wheat/food prices and supply chain issues.

- Stocks with high exposure to Russia economy and raw material costs would be ones to look at (hedge short-sell). We put on short-term hedges on stock indices, SPY ETF and certain stocks (i.e Citigroup, Philip Morris, Pepsi, Tesla) as well while keeping FX and Commodities exposure. Having said that, we are cautiously optimistic Ukraine & the World will prevail against Russia earlier than expected.

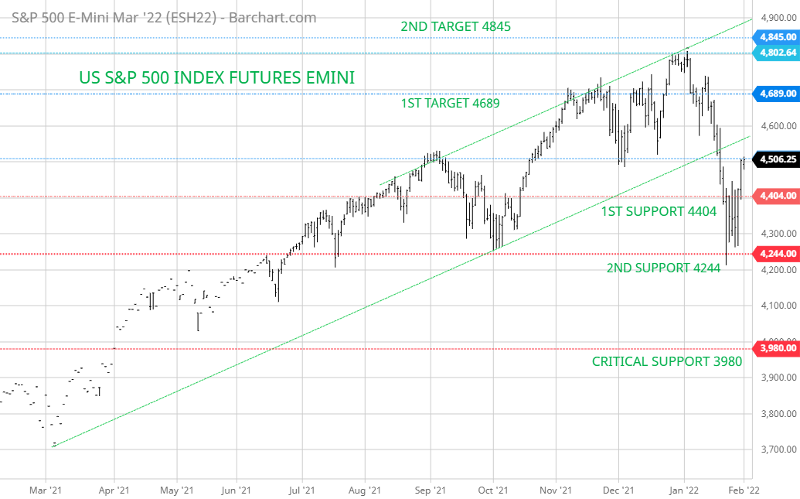

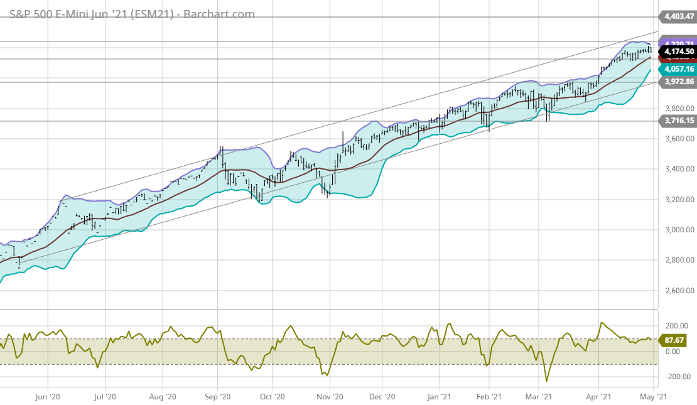

- The ‘black swan’ event now has occurred but a further escalation of the Ukraine war can raise inflation and oil prices even more, leading to a sharp fall in business and consumer confidence. The risks that 3980 is broken is there and if it occurs, a potential correction to 3200-3400 support level (20-30% pullback from peak).

- We put on short-term hedges on stock indices, SPY ETF and certain stocks as well while keeping FX and Commodities exposure.

- Having said that, we are cautiously optimistic Ukraine & the World will prevail against Russia earlier than expected.

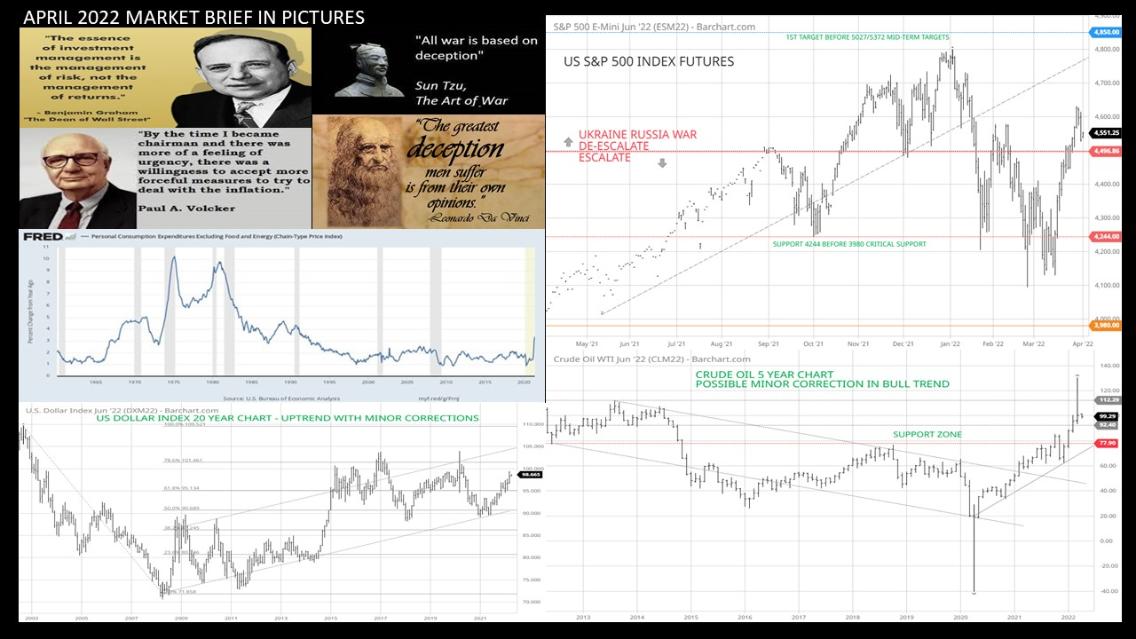

- Short-term Risk-Reward ratio for US S&P 500 index is poor as at 4300 level, potential upside at 4850 & downside at 3980/3400. Potential 12% gain with potential 20% loss.

Conclusion

“Markets are constantly in a state of Uncertainty and Flux.” George Soros

The Covid pandemic war is the first war or uncertainty that hit markets since 2020. The 2nd being inflation and rising commodity prices. 3rd being the Russian-Ukraine war. To understand how the 3 interplay is more complex and to anticipate scenarios is important to take into account defensive actions to hedge. Thus, a global macro/CTA/multi-strategy inherently looks for dislocations and try to see if all 3 are align and to act accordingly – bullish, bearish or neutral.

The re-opening continues to be in earnest in US and UK. The light at the end of tunnel for US with the most deaths due to Covid19 is the basis to be more positive. Thus, our overweight focus, where 2/3 of our capital is deployed into US stocks, bonds, commodities and currency markets remain. The unemployment rate falling to 3.8% is another bright spot that Jerome Powell said labor market was extremely tight, meaning close to full employment and resulting in higher wages, which isn’t a bad thing for a robust economy.

-

Thus, it is not all doom & gloom as our hopeful view of Ukraine and a firm US economy makes us vigilant for bullish opportunities as stock prices fall.

We end with our golden rule: ‘Anticipate’ not ‘React’ to market events.

-

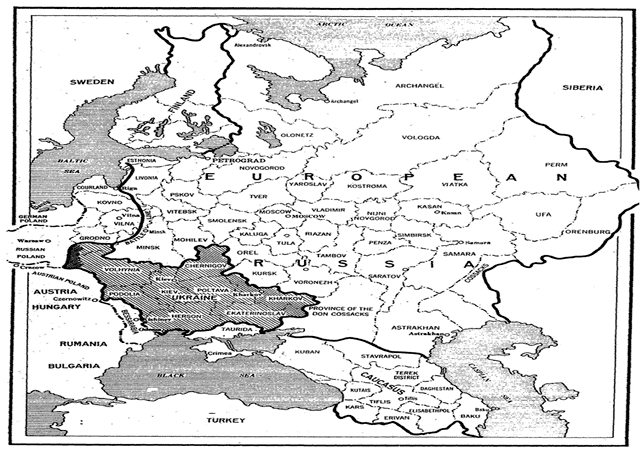

History lesson: In this 1919 caricature (bottom left), Ukrainians are surrounded by a Bolshevik (to the north, man with hat and red star), a Russian White Army soldier (to the east, with Russian eagle flag and a short whip), and to the west a Polish soldier, a Hungarian (in pink uniform) and two Romanian soldiers. Old Ukraine map as independent nation in 1917 before USSR - Soviet Union was formed in 1922 and they even speak a different language from Russians. Wikimedia Commons:

3 Feb 2022 market newsletter – "Instead of hoping he must fear and vice versa."

"Instead of hoping he must fear and instead of fearing he must hope.”

Jesse Livermore, 19th century stock & commodity trader

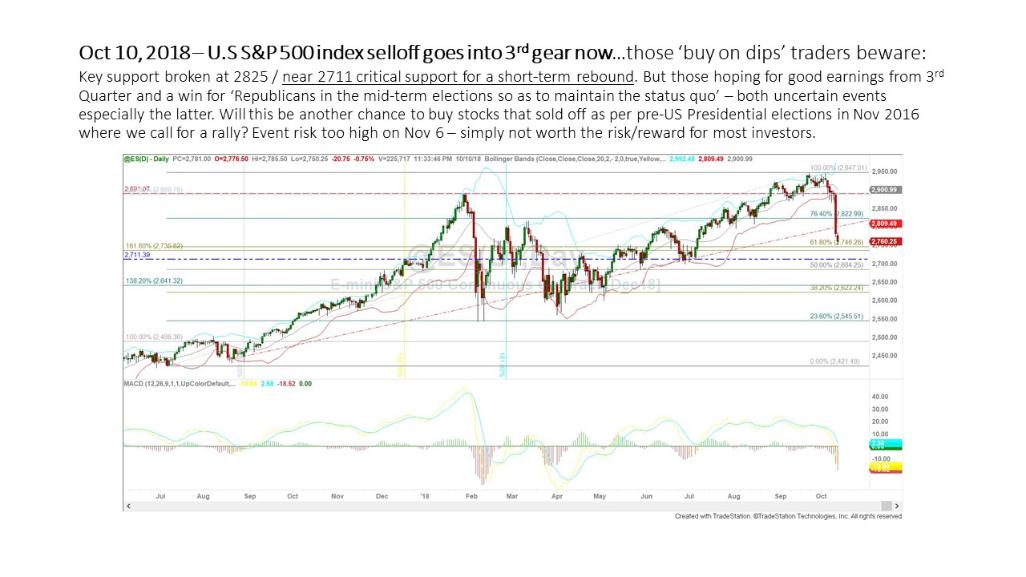

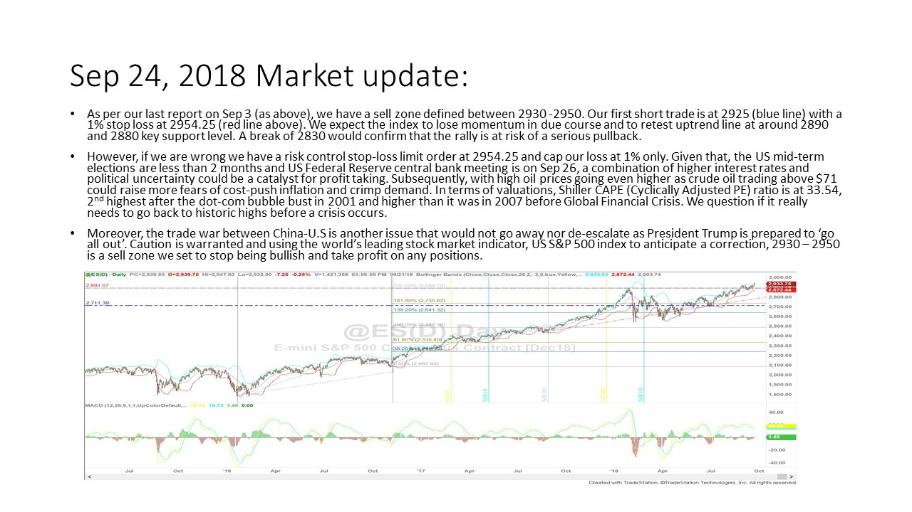

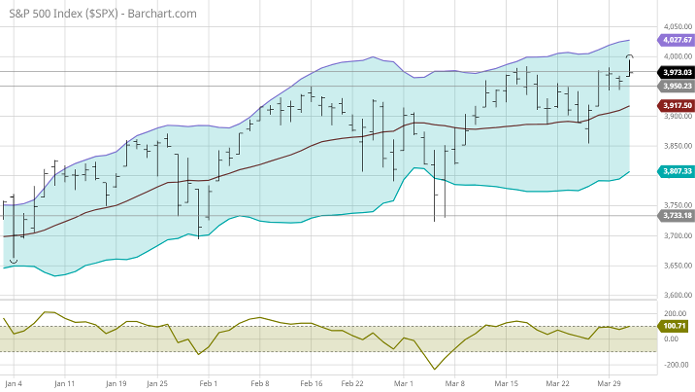

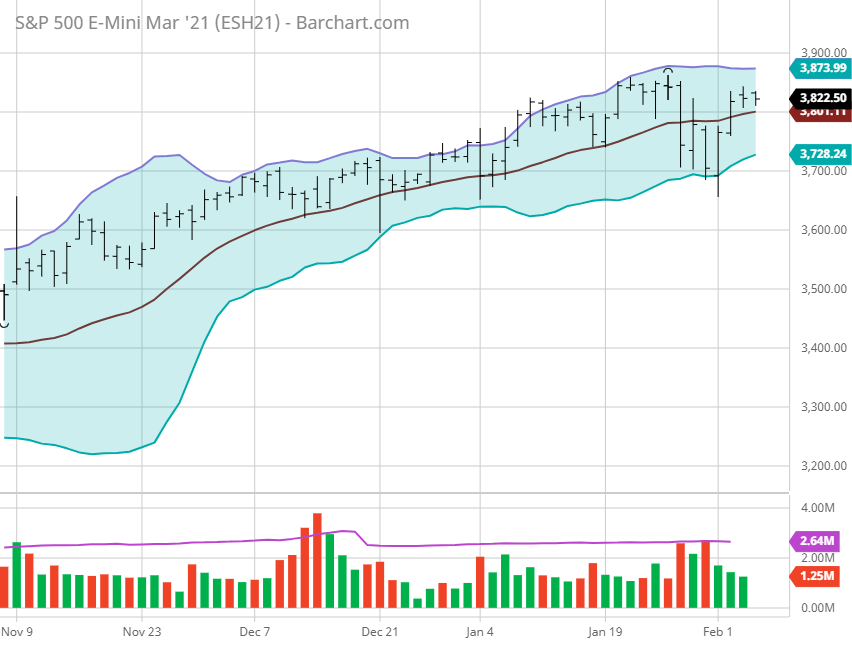

The US stock market, S&P 500 stock index rose to new high of 4818 on 3 Jan 2022 before closing at 4515.55 on Jan 31. The 27% gain last year has long been forgotten as inflation and lower corporate earnings guidance for 2022 become prevalent.

Our target of 4845 was missed by 0.6%. But as we always knew, we can only anticipate as best as we can, not predict and used our risk management and dynamic asset allocation model to deal with the risks and any wrong analysis. But the stock index did test our support levels of 4400 and 4244 before reversing as we wrote last month: “A market correction is probable to 4400 level (10-12% pullback) but will likely setup for a rise to 5027 and 5372 in the mid-term.”

US retail sales rises 3% per year historically but in recent years due to the large fiscal and monetary stimulus, retail sales boomed by 10% in 2020-21. This big rise in demand with supply chain disruptions and Covid lockdowns had caused an inflationary spiral globally pushed higher by shipping and freight rates. US corporate earnings have potential to go beyond the record US$3 tril and strong stock buybacks.

As a global macro/multi-strategy fund, 'dynamic asset allocation' to other asset classes helps reduce risks and hedging using put options is one of the effective tools besides short-selling stock index futures, SPY ETF index and selective weak single stocks. The failure to diversify to other asset classes is a classic issue and the complacency that 'business as usual' for equity markets is typically why losses occur.

Not only were we believers of “re-opening stocks and sector rotation to value stocks”, we were concerned about technology stocks and we even warned against buying Apple stock on Jan 3 when it became the 1st US$3tril market capitalization company. Soon after Apple fell 15% until its results came out:

“But, now is the time to be cautious at such lofty valuations and without the founder Steve Jobs to create magic or ‘creative destruction’. All business cycles face periods of challenges as the profits rise 30% but the stock goes up an extra 50%.”

The recent 26% fall in Meta (Facebook) stock price in a day on slowing digital advertising growth was long overdue, while Alphabet (Google), Snap, Microsoft, Apple and Amazon reported better profits than expected. Digital marketing long been touted as the way to monetize new startups, help companies sell to more consumers and even create brand awareness may often be just a perception as the results had always been less than desired; reaping massive profits for the digital advertising firms, influencers, social media platforms and websites. Expect more casualties as regulation on cryptocurrencies, metaverse and NFTs are coming as the 'Wild West digital world' has undesirable effects for investors and social impact on teenagers.

Rollercoaster ride of Bitcoin continues but as a valid medium of exchange, store of value and inflation hedge or just a speculative asset class is highly debatable and a matter of perception; but it is vulnerable to abuse by self-serving promoters, fraudsters and money launderers. Holding US$35,000 support can keep positive action to test $70,000. But, only astute traders can trade in highly volatile 2-way markets.

The WHO (World Health Organization) data shows the current Omicron Covid pandemic has raised number of weekly cases by about 3x than in Mar 2021 however the death rate is only about half that.

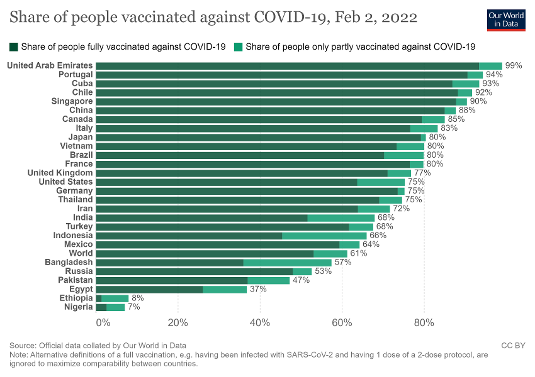

The chart on the left above show vaccination rates globally is now 61% for 1 dose and fully vaccinated at 53%; not yet at 90%. For example, in US 63%, UK 71%, China 85%, India 51%, France 76%, South Korea 85%, Japan 79%, Canada 79%, Germany 74%, Thailand 69%, Indonesia 45%, Russia 48% and South Africa 28%. This Omicron wave may take a few more months to end globally and if history is any guide the 1918 Spanish Flu ended in 1920 April.

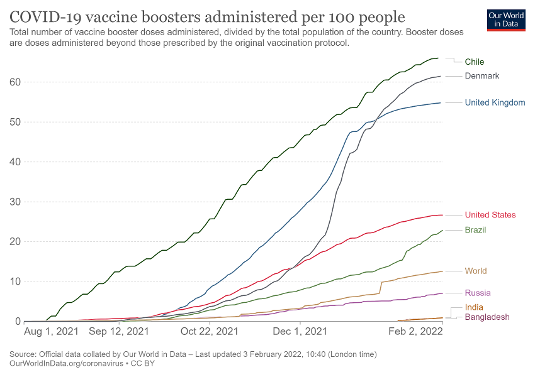

The chart on the right above shows how the progress globally on booster shots and this may longer to reach 60% levels. Covid vaccines is a big game-changer as we said last year when vaccines were approved by FDA and then rollout globally. But to defeat this pandemic war, boosters are needed to reduce the spread and further deaths and break the vicious circle.

The kind of vaccines used is also crucial as scientists had proven that Pfizer-BioNtech and Moderna has the highest efficacy and booster shots against the new variants. Countries that uses other vaccine makers may be at risk of spreading the virus if Omicron widens. An interesting research by Harvard researchers on 1918-19 Spanish Flu found correlation between “bad weather and the Spanish flu effect” and that may be useful for a study in 2020 Covid19 outbreak and climate change effects.

ESG investing should no longer be optional but a part of every investor's core approach. The time to sit back and wait for the scientists and politicians to debate about climate change is over.

ESG or Sustainability investing to us is looking for innovative solutions to 4 key areas – Environment, Education, Healthcare and Corporate Governance on a global level. Some examples are solar, wind & renewable energy firms, Electric transportation (cars, scooters, ships, yachts, buses and planes), vegan-meat companies, education-technology, global healthcare companies and strong global corporate governance (such as wages, diversity, net-zero carbon emissions, dividends, CSR etc)

The Biden infrastructure plan will boost electric charging and renewable energy projects; in line with US's goals to be net zero by 2050, 50-52% reduction by 2030 and 100% clean power sector by 2035. Much needed R&D in these areas will spur jobs and new innovations, plus enlarge the investable ESG universe.

The inflation and rising raw material costs is not to be dismissed as we wrote last month:

A) “The rise in oil, natural gas and gasoline prices rallied in December and is on a trend higher to test multi-year highs. The probable target range is $85-110 (high in 2009 at $150 will be far out but not impossible).

Crude oil prices had risen to $88 in Jan 2022 making the appreciation over 70% from 1 year ago and more than 5x from lows in Apr 19, 2020 when oil went negative. WTI oil price have risen almost 20% so far and with OPEC+ on a gradual increase in output would not help as previously agreed 400,000 barrels in March may be insufficient to stop the rally especially as geo-political tensions in Ukraine-Russia and Middle-east exist. The 2020 negative oil prices had forced OPEC to cut production drastically and now is a time for them to reap what they sow as supply constraints and oil companies under pressure by COP26 climate change agreement to cut back fossil fuel exploration and put more resources to expand renewable energy output.

B) Rising food prices due to higher wheat, soybeans, grains, coffee and corn prices are not going to reverse soon due to fundamentals of supply & demand (due to climate change/bad weather that affect crop harvest). Commodity feedback loops that drive prices higher via fundamentals & sentiment are interlinked. The “classic cure for higher prices is higher prices”.

The chart on the top of rising wheat futures prices over 3 years. Wheat is used for bread, noodles, muffins, pasta, biscuits, cakes, cereal bars, sauces and beer too. Wheat feed or bran is used for feeding animals chickens, horses, cattles, sheeps, pigs etc. Basically, almost all we consume daily depends on wheat and the rising price would be passed over to consumers to some extent but not fully as food producing firms that don't own the farms or flour mills trying to absorb the higher costs for now, but not for too long.

Wheat prices is looking likely to test multi-year highs of 2010-12 having risen 18% from last year and 62% from lows in 2020. The inflation now is quite similar to 1918-20 Spanish Flu/World War 1 1914-18 period as Wheat rose 400% from 1915-1920; pig iron rose 300% and cotton 400%.

Overall, current food prices had risen at the fastest pace in 13 years as US Labor Department recorded a rise of 6.5% in 2021. The data showed that Fast-food restaurants raised prices by 7.1% in 2021 due to inflation.

See below for summary table of rising commodities prices:

Commodity

WTI oil

Gold

Copper

Steel (US Midwest CRU)

Aluminum (COMEX)

Corn

Wheat

Coffee

Soybean

Sugar

Cotton

Lean Hogs

Live Cattle

Rough Rice

% gain in 2022

22.00%

-1.20%

1.00%

-19.00%

8.90%

4.90%

-0.60%

7.20%

16.10%

-3.00%

12.20%

16.20%

1.50%

2.40%

% gain from 2021

76.00%

-0.90%

27.40%

43.00%

42.00%

36.10%

18.00%

81.00%

38.00%

21.00%

54.00%

31.30%

16.30%

17.00%

% gain from 2020

650% (using $17 low)

24.00%

122.00%

128.00%

110.00%

100.00%

62.00%

168.00%

86.00%

80.00%

151.00%

143.00%

84.00%

31.00%

Federal Reserve Chairman Powell on inflation and dealing with it on Jan 11: “If we see inflation persisting at high levels longer than expected, then if we have to raise interest more over time, we will.”

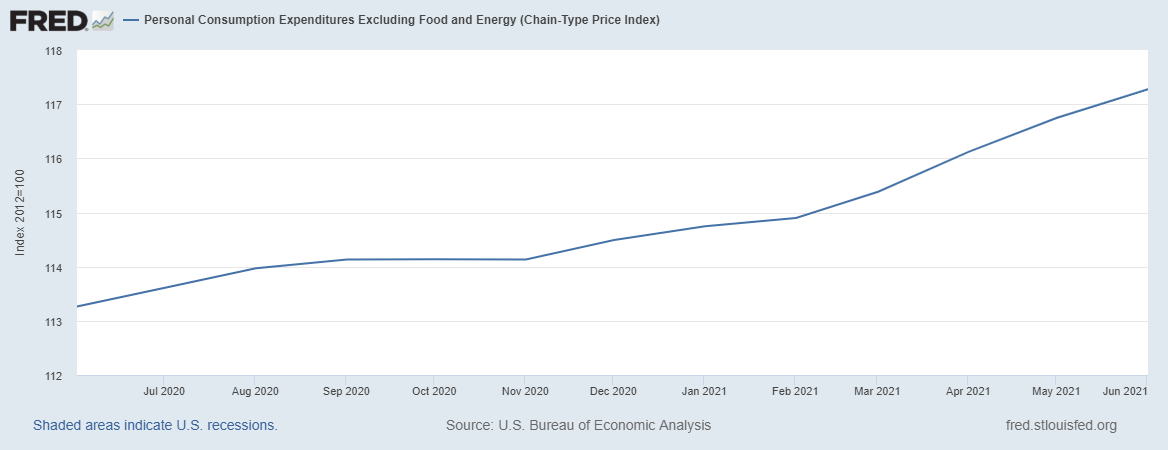

US inflation rate for Dec rose to 7% from a year ago, 40 year high and CPI rose 0.5% vs Nov. Taking out food and energy, core inflation rose 5.9%. Wages also have jumped 5.7%. Inflation is a big issue now but yet doing too little or too much may hurt sentiment, hence Fed's communication tool box matters.

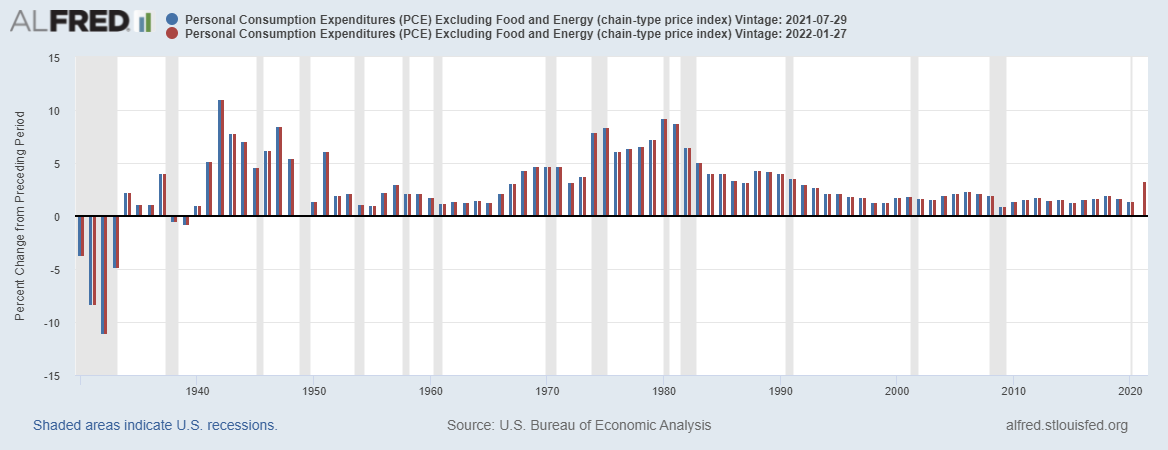

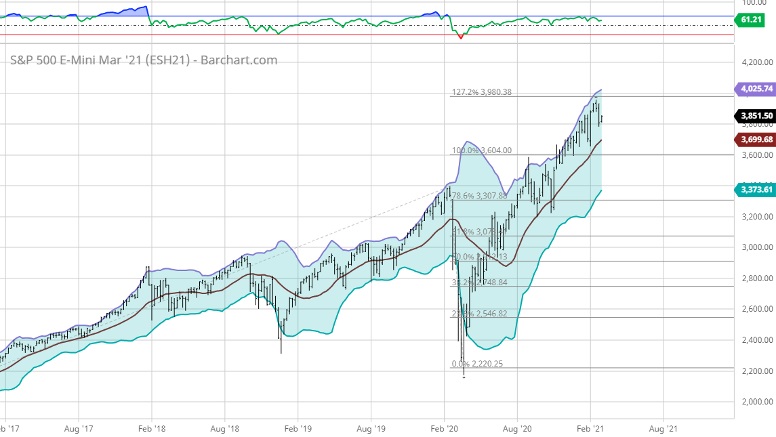

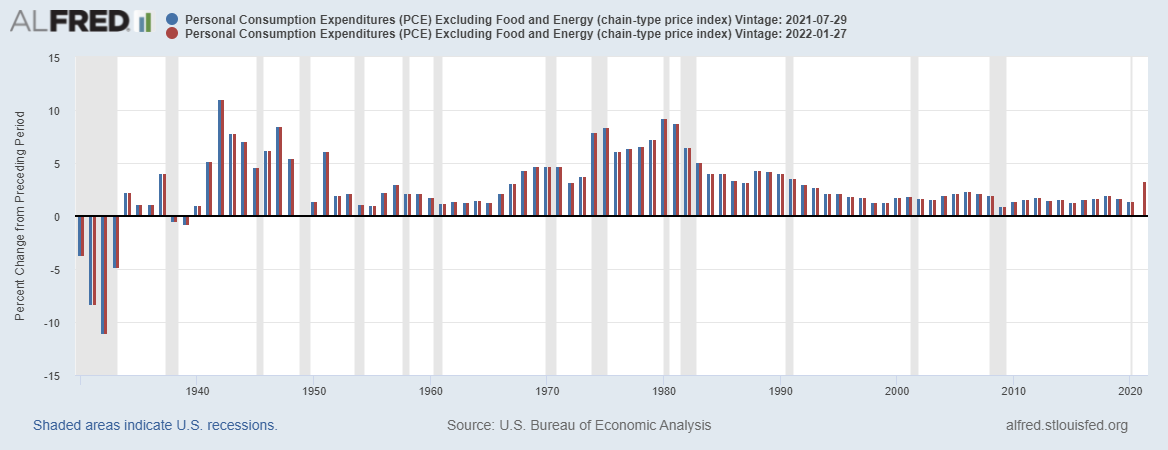

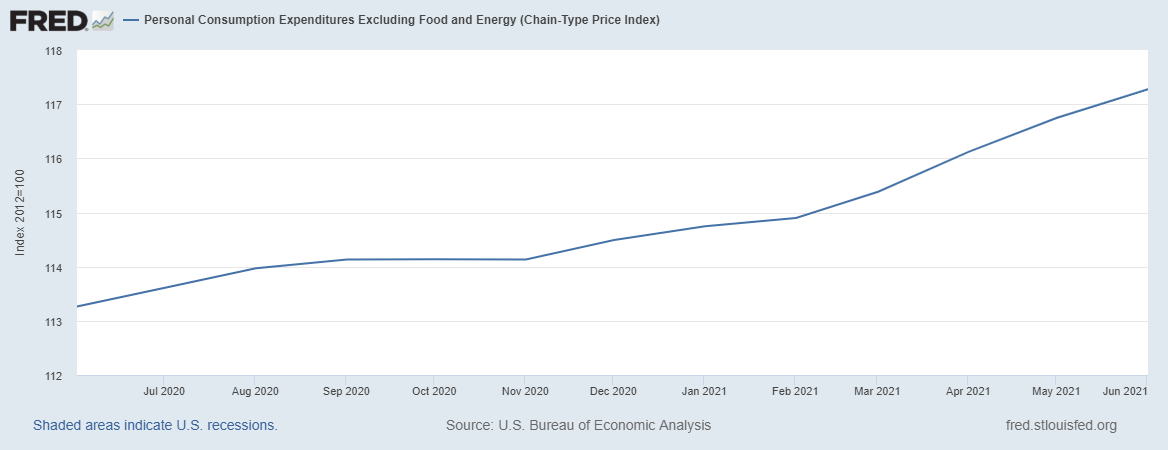

The historical trend of PCE – Personal Consumption Expenditures excluding food and energy from 1930 vintage on left chart and we can draw some conclusions: The current PCE inflation has gone above 1992 high and it remains to be seen if Federal Reserve's interest rate hikes alone can stop the inflation trend from going higher. It may be reminiscent of the 1967 run up to 1971 followed by a fall in 1972-73. The outlier event risk would be a similar 'big leap forward from 1974 to 80'. Obviously, history does not repeat exactly but it can have some similar patterns.

Source- US Bureau of Economic Analyses (from St Louis Fed)

The US Dollar is in a bullish trend change as the Fed rate hikes for 2022 could be 4-5 and a reduction in Fed's 8tril balance sheet would result in lesser debt issuance, making US Treasuries more attractive and result in a dollar demand; as inflation and rate hikes will make USD a better alternative asset class than JPY, EUR, AUD or GBP.

The need for more US dollars as oil prices are likely to trend above US$100 and many countries need to be prepared. BOE hikes second time due to inflation and sharp rise in consumer prices. ECB and BOJ have been hesitant to act to raise rates for now.

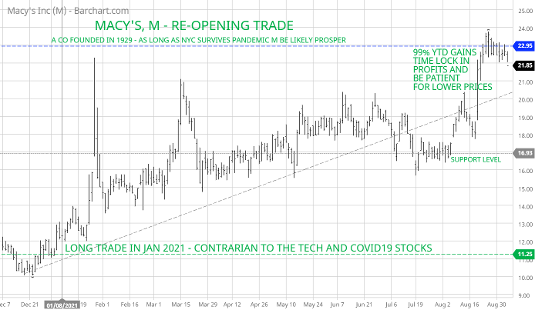

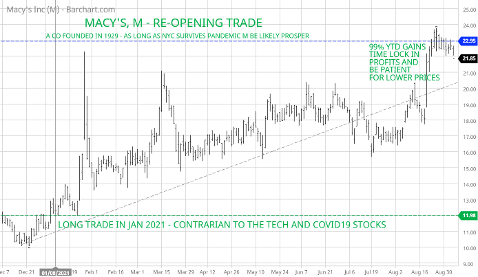

Away from technology stocks, there are other growth stocks with good opportunities in 2022 such as Boeing, Macy’s, Coursera, Kraft Heinz, TSMC, Global Foundries, United Health, Tyson Foods, Beyond Meat, Moderna, Hilton, Marriott and OTIS.

The slide in Covid19 stocks like Stay-at-home and Work-from-home (and some China tech) stocks last year are still not over as classic ‘sector rotation’ tactical strategy that some investors either chose to disbelieve or were ignorant due to lack of guidance by their advisers.

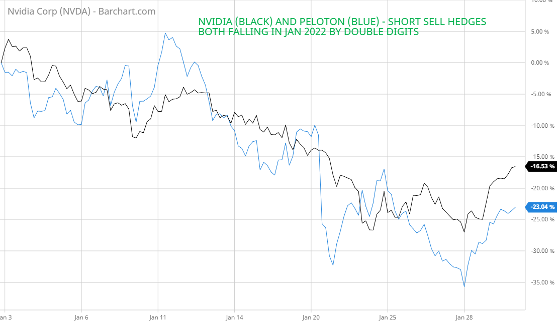

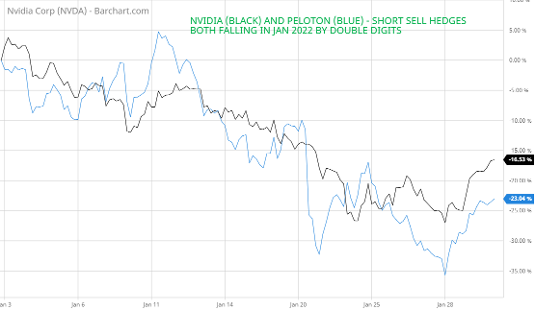

Thus, we had 2 bearish short-sell hedge in our Jan 3 market report: Peloton and Nvidia which both fell over 20% (see chart on left)

The ‘black swan’ event is a military conflict or major political event that disrupts supply chains which in turn raise inflation and oil prices, leading to a sharp fall in business and consumer confidence. The risks are low but if it occurs, a market correction to 3984 support level (20% pullback) would be likely.

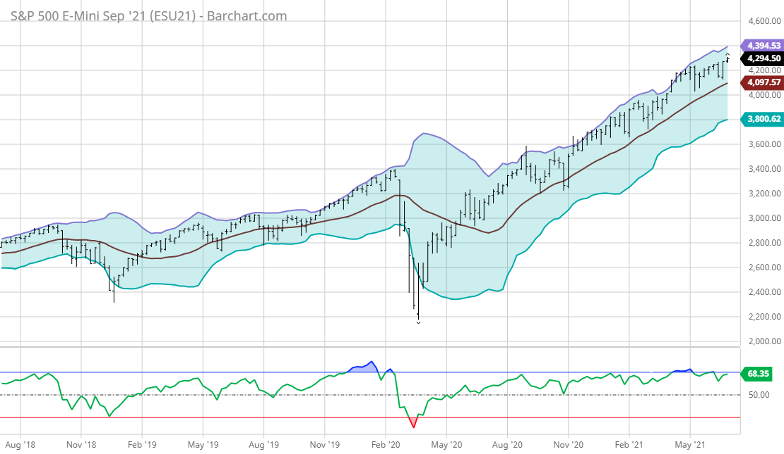

Short-term Risk-Reward ratio for US S&P 500 index is quite good as at 4500 level, potential upside at 4953/5072 & downside at 4400/4244. Potential 10-12% gain with potential 6% loss.

3 Jan 2022 market newsletter – "Calibrate not follow."

“If you realize all things change, there is nothing you will try to hold on.”

Lao Tzu, ancient Chinese philosopher 571 BC

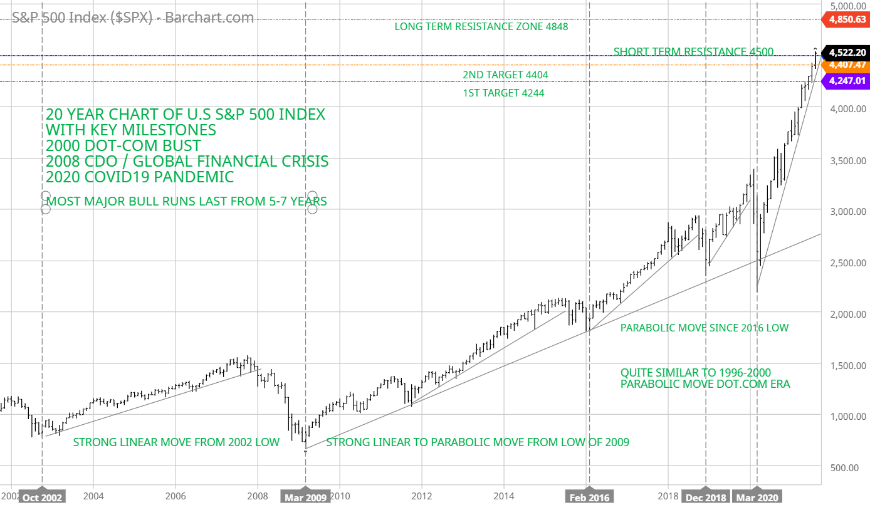

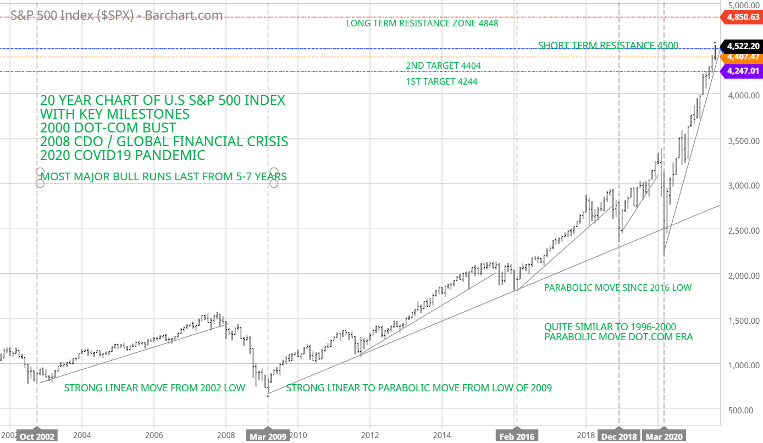

The US stock market, S&P 500 stock index rose to new high of 4808 on 30 Dec 2021 before closing at 4766 on Dec 31. The 27% gain is twice the average target by most bank analysts.

Our own target of 4404 was exceeded and we did a quick reassessment to realize we were not positive enough and rectified it to 4848 in Sep 2021 and to 4953 in Oct 2021.

The full vaccination rates globally is now close to 60% and the re-opening of economies is a natural extension of human nature and civilization. No one wants to be stuck at home 24 hours or be deprived of eating in a cafe or exercise at the gym. The game-changer we said last year was when vaccines were approved by FDA and vaccine rollout globally.

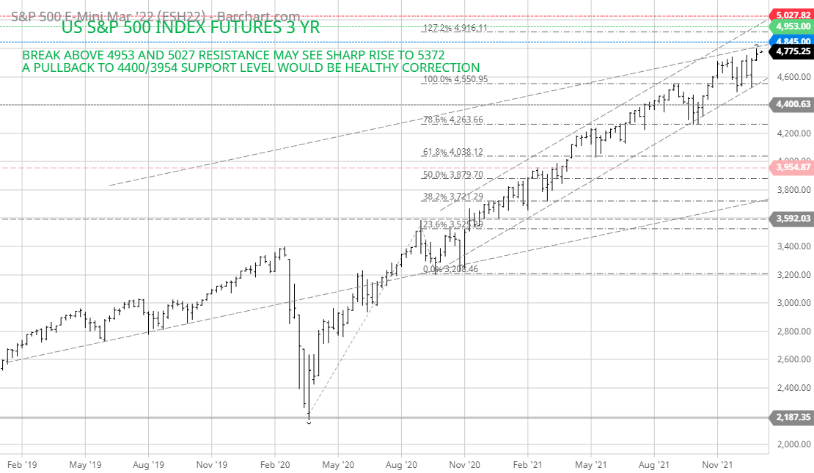

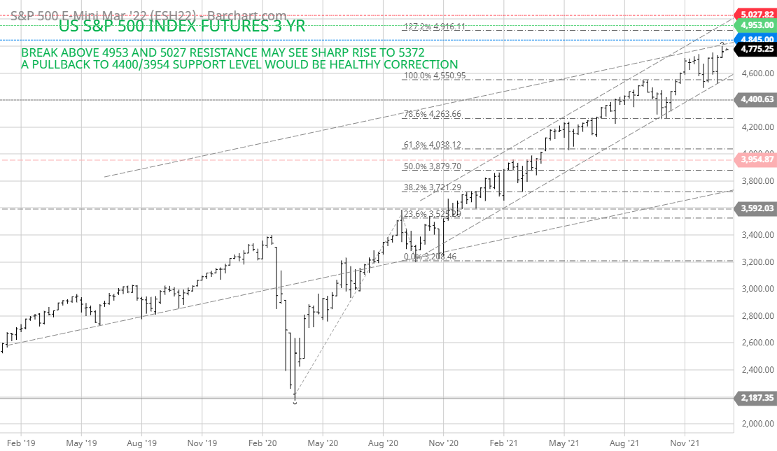

Thus, our new forecasts for S&P 500 index in the near term is 4850 and 4953. A market correction is probable to 4400 level (10-12% pullback) but will likely setup for a rise to 5027 and 5372 in the mid-term. (median forecast of Wall St analyst is 5050)

The only ‘black swan’ event is any military conflict or rise in geopolitical tensions that disrupts supply chains which in turn raise inflation and oil prices, leading to a sharp fall in business and consumer confidence. If that happens, a major correction to 3984 support level (20% pullback) would occur and may spiral even lower depending on how severe it is.

The valuations of some stocks and certain markets are concerning especially in the crypto space. There is little evidence that Bitcoin is a valid medium of exchange. Inflated assets of properties in some countries, art and US technology stocks would need to adjust to new reality of inflation, supply chain disruptions, weaker consumer demand and cost of regulation.

The Covid19 stocks like Stay-at-home and Work-from-home (and some China tech) stocks had a large reset last year. That was a classic ‘sector rotation’ tactical strategy that some investors either chose to disbelieve or were ignorant due to lack of guidance by their advisers. Regardless, it was a good hedge for us by taking the bearish short-sell which was just recognizing that change is the only constant and the path of least resistance prevails.

The rise in oil, natural gas and gasoline prices rallied in December and is on a trend higher to test multi-year highs. The probable target range is $85-110 (high in 2009 at $150 will be far out but not impossible). Given that OPEC+ to increase oil supply by 400,000 per day in Jan may only be 130,000 bpd and probably 250,000 in Feb due to production constraints of Angola and Nigeria. The demand side is firm but likely to grow in Feb-Mar onwards as booster vaccines and peak in Omicron occurs, opening air travel and work in office. COT, Commitment of Traders report shows commercials and producers are net long while speculators / non-commercials are short – support for higher prices. The Biden infrastructure plan will boost construction activity.

Rising food prices due to higher wheat, soybeans, grains, coffee and corn prices are not going to reverse soon due to fundamentals of supply & demand (due to climate change / bad weather that affect crop harvest). Commodity feedback loops that drive prices higher via fundamentals & sentiment are interlinked. The “classic cure for higher prices is higher prices”.

The US Dollar is in a bullish trend change that is likely to ebb and flow with Fed tapering ending in March and rate hikes could result in a dollar demand as on the Dec 16 Fed chairman had given his most frank assessment of inflation as potentially being entrenched. The world order of US dollar would only change in the event of a global conflict or China monetary holdings of US Treasury or peg exchange rate changed dramatically. The strategic oil reserves that US have may partially mitigate to some extent how rising energy prices hits its economy.

As a global macro/multi-strategy fund, 'dynamic asset allocation' to other asset classes helps reduce risks and hedging using put options is one of the effective tools besides short-selling stock index futures, SPY ETF index and selective weak single stocks. The failure to diversify to other asset classes is a classic issue for investors. The complacency that 'business as usual' for equity markets is typically why losses occur.

Apple became the 1st US$3tril market capitalization company and we highlighted in our last month’s report that it is the ‘most innovative & positive thinking’ company globally. We were bullish in Jan 2021 at $130+ price level but became neutral as it rose to $150 and at $180, it rose 35%. But, now is the time to be cautious at such lofty valuations and without the founder Steve Jobs to create magic or ‘creative destruction’. All business cycles face periods of challenges as the profits rise 30% but the stock goes up an extra 50%. But Steve Jobs has a great quote: ‘You can’t connect the dots looking forward, you can only connect them looking backwards’ (you can’t extrapolate and expect things to go straight line’).

There are other value stocks with equally good opportunities such as Boeing, Macy’s, Coursera, General Mills, Kraft Heinz, Global Foundries, Moderna, Hilton, Marriott, and OTIS (chart below).

The speculative fever in Bitcoin at $46,000 would not end soon until major regulation by US or UK occurs that may result in a panic crash. The rise above $60,000 and reversal may be due to institutional traders re-assessing if the central thesis as a medium of exchange or store of value hold true, besides being another investment asset class. Support level of $35,000 is critical for bullish action to test $70,000. Only astute traders can trade in highly volatile 2-way markets.

Short-term Risk-Reward ratio for US S&P 500 index is mediocre as potential upside at 4953 & downside at 4400. Potential 3% gain with potential 9% loss.

3 Dec 2021 market newsletter – "Positive Thoughts, 1 small step for man."

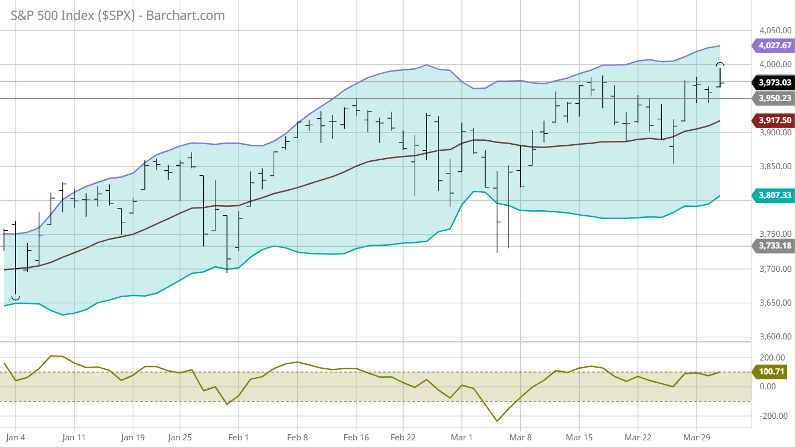

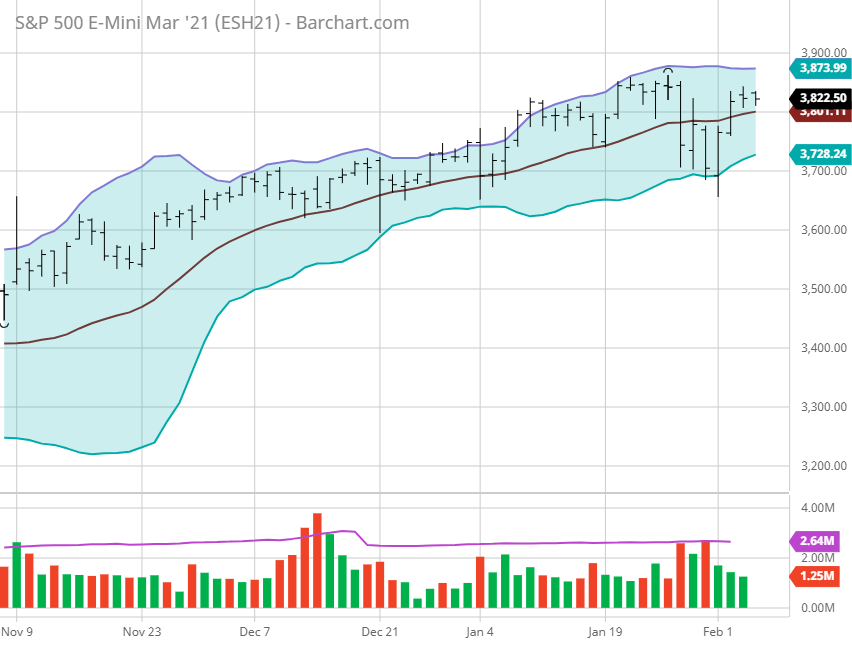

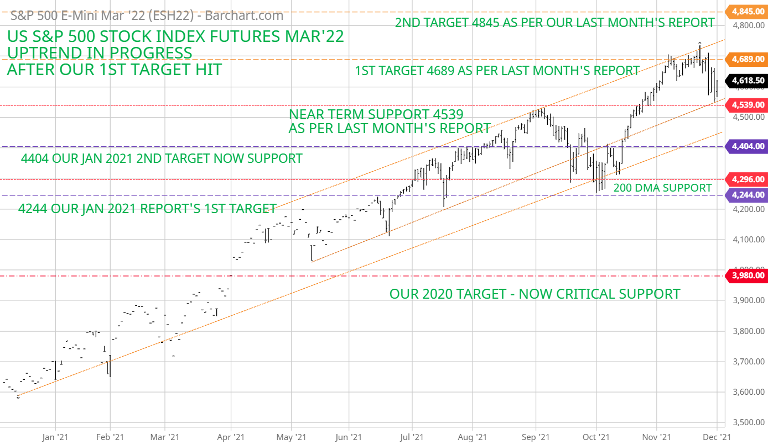

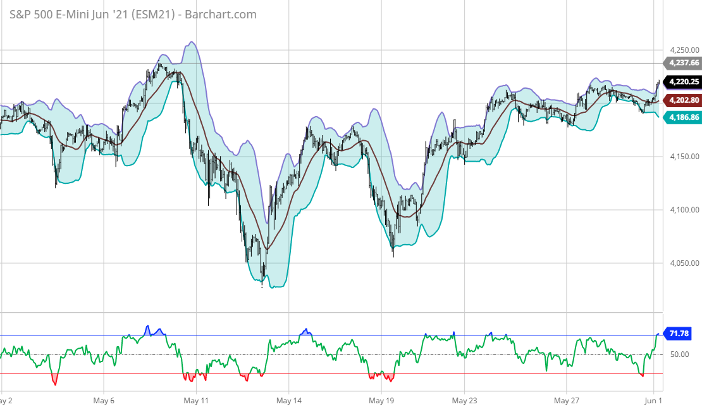

The US stock market, S&P 500 stock index rose to new high of 4743 before a correction to 4501 low on Nov 30, about 5% correction from the high. Last month, we warned a correction in the bull market is possible given the gains this year: “Risk-reward ratio for US S&P 500 is not great as potential upside at 4689/4845 & downside at 4210 – 3980, Potential 5% gain with potential 9-14% loss and key support levels: 4539 & 4210 (200 DMA)”

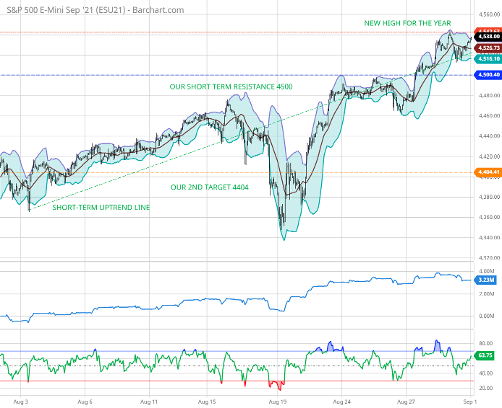

The S&P 500 hit our support level at 4539 and could test 4404 our previous target now turn support (see chart above). The trend is still bullish and a test of 4400 (key support) to change the trend higher for the Christmas rally is probable. The 'positive thoughts' since Covid19 vaccines were found will not fade easily.

Our Oct 2021 report: “A higher target of 4600 to 4848 may be feasible in 2022 once the 'weak hands & Robin Hood' traders are shaken out. Of course, nothing is cast in stone when it comes to the markets especially with runaway inflation, interest rate expectations, Federal Reserve Chairman Powell's nomination for 2022, US mid-term elections in 2022 that could change the power dynamics and a slowing growth situation in China ...”

We re-assessed the market conditions and conclude that the Fed tapering of US$15bil per month was not fast enough. 2020 stimulus would push mid-term target higher, unless a 'black swan' event, the downside may find support at 4090 and 3980.

Our Nov 2021 report: “The targets we set at 4244, 4404 and 4500-4600 short-term targets have been exceeded and our new target of 4689 before 4848 for 2022. Support level on the downside is at 4400 and 200day moving average at 4210 (capping a 10% minor correction). The resistance at 4953.”

The OPEC+ to increase oil supply by 400,000 per day in Jan due to fear of omicron variant and US overture. This may delay the rally in prices but not change the trend. The demand is still strong as growth rates are likely to stay firm and supply chain issues still clearing the backlog. Commodity feedback loops to drive prices higher as fundamentals and sentiment are interlinked. The probable target range is $80-100 next year (high in 2009 at $150 may not be impossible in 2022).

Throughout 2021, we highlighted Sector rotation away from 'Stay home or WFH-work from home' stocks to Re-opening/value stocks, our Apr 2021 report:

“Sector rotation (these are trends not to be dismissed) - As technology stocks fell in Mar, value stocks rose & fell: Many value stocks underwent a correction...these stocks had risen more than 20-30% in the last 3- 6 months. Sector rotation is likely to be continue in 2021. Prof Robert Shiller, Nobel Laureate and famed author of 'Irrational Exuberance' said last year of Covid19 vaccines, a game-changer.”

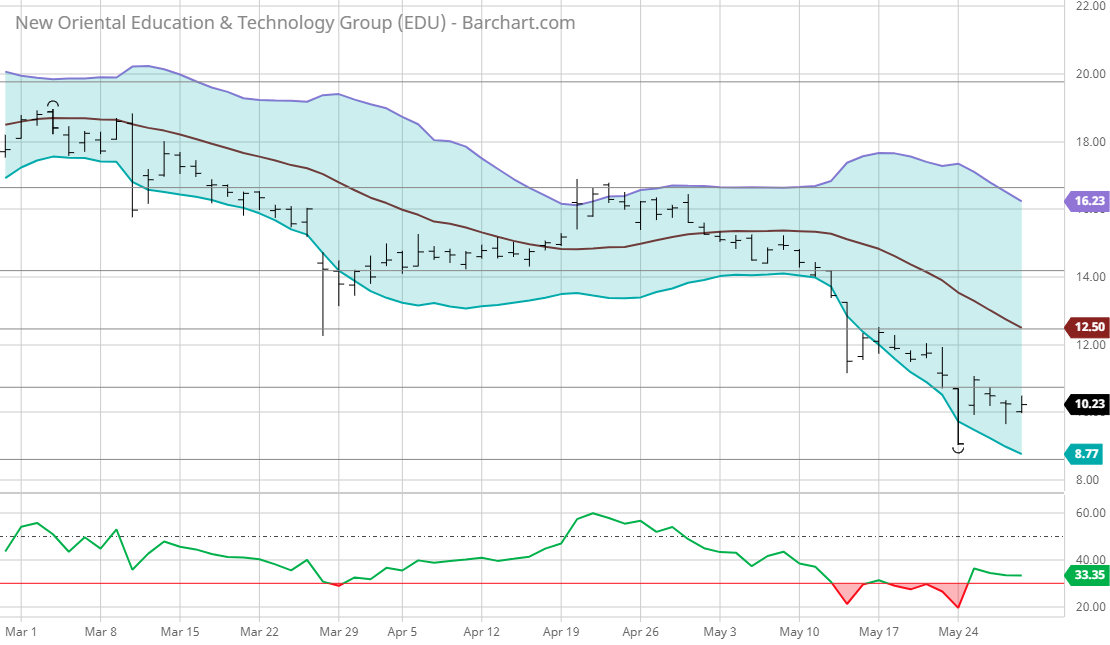

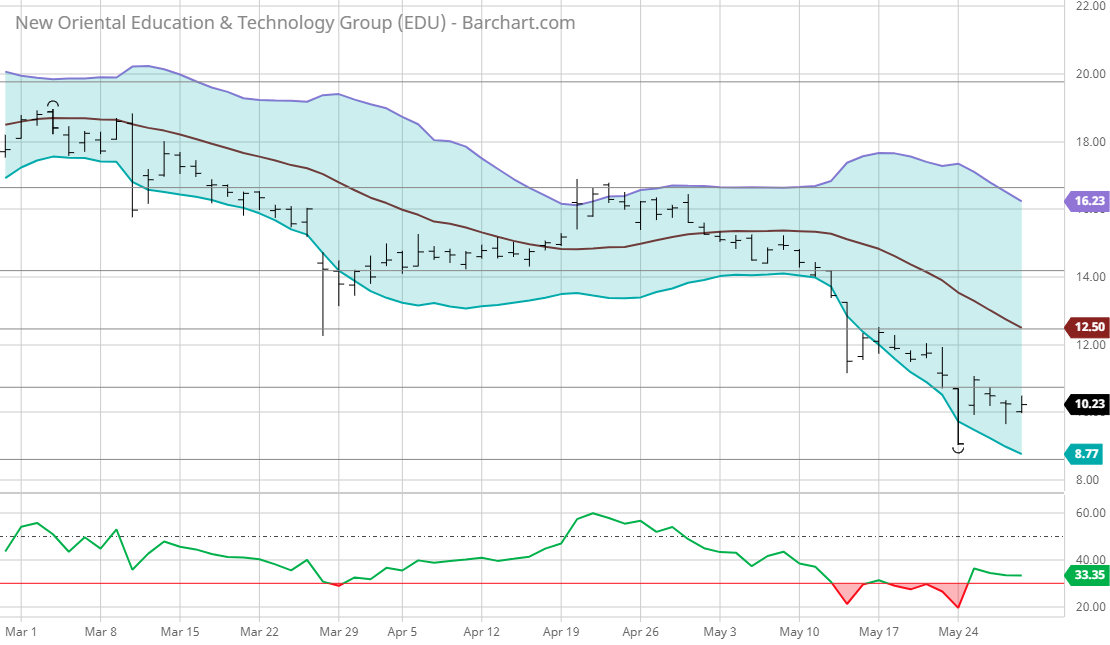

In May 2021, we wrote: “The ones to be really concerned about or even consider hedge (short-sell) are China stocks in general (BABA, JD, PDD, BIDU and TME are on decline since peak in last few months; worst the online education stocks GSX, TAL and EDU; EV firms like NIO and LI are all in bear territory). We can make some educated guesses that selling started due to regulation by China authorities and also US legislation requiring China listed ADRs to similar stringent audit as other listed firms in US or risk being delisted. Archegos liquidation of some Chinese ADR stocks can explain part of the selling but not all. It is better to let the market tell us what to do rather than seek reasons to justify holding on.”

In June 2021: “Too many investors are still in the era of 'Work from Home' and hold large chunks of stocks that carry much risk. A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the market risks as over speculation in cryptocurrencies and single stock names have raised complacency. We remain bullish commodities but prices are near our short-term targets (refer to Cross-Asset Class section). JP Morgan CEO Dimon one of the most vocal CEOs said to end Zoom meetings and return to office by July, same for Citigroup CEO and Google. Apple and Microsoft are also encouraging workers to return by June.”

Some of the 'Covid stocks' above have fallen (Year-to-date, YTD Dec 3, 2021): Zoom -43%, Clorox -17%, Teladoc -50%, Peloton -70%, New Oriental Education, EDU -88%, TAL Education -90%, GSX (new name GOTU) –95%, Las Vegas Sands -40%, Baidu -31%, Alibaba -47%, JD.com –10%, Pinduoduo -69%, NIO –25%, Docusign -39%.

This is what we call “high risks of holding single stock names, not being diversified and being rigid in analysis” (In contrast, 're-opening' stocks: Macy's +140%, Apple +23%, Otis +22%, Morgan Stanley +44%, Marriott +14% & US Dollar +7%, Oil +50%, soft commodities +20%> average).

Fed Chairman Powell's testimony at end of Nov, to speed up Fed Tapering by 'few months' has the CME FedWatch Tool for Fed Funds rate see a slight uplift: 45% probability of an interest rate hike in June 2022 meeting with target rates at 25-50bps, 31% chance at 50-75bpts by July 2022.

The US Dollar is in midst of a rally that runs counter to higher energy & commodity prices. But, the focus is on Fed tapering that Fed chair Powell has said they may speed things up and speculation is the Dec 15 FOMC meeting, an increase in the Fed taper is likely as high inflation becomes a serious issue.

As a global macro/multi-strategy fund, 'dynamic asset allocation' to other asset classes helps reduce risks and hedging using put options is one of the effective tools besides short-selling stock index futures, SPY ETF index and selective weak single stocks. The failure to diversify to other asset classes is a classic issue for investors. The complacency that 'business as usual' for equity markets is typically why losses occur.

Bitcoin rose above $60,000 and reversed. Support level of $35,000 is critical for more bullish action as new investors are ready to join the party. Only astute traders can trade in highly volatile 2 way markets.

Risk-reward ratio for US S&P 500 is slightly better but not great as potential upside at 4845 & downside at 4244 - 3980. Potential 7% gain with potential 12% loss.

3 Nov 2021 market newsletter – "An intelligent man - genuine needs’

The markets are always one step of us and it pays to keep constant vigilance. The base case can only be anticipated to a certain probability and not with certainty and what George Soros call fallibility in his Reflexivity theory.

We believe if we can get 70% of our market views right and use risk control for the 30% we are wrong, our chances of survival is pretty good. The Covid19 pandemic has been tragic for many who lost their lives and loved ones. But yet the rush to buy stocks and cryptocurrencies has been on a tear.

Financial markets and reality diverges is a reality that many fail to notice and to discern the turning points. It may not be tomorrow or next year but it is the job of any astute fund manager be in-tune/anticipate the nuances of the markets, including political affairs. Early this year, or even 6 months ago, many experts and even the Federal Reserve did not anticipate higher inflation or any tapering of bond purchases or even interest rate hikes.

We were one of the early ones to warn of “inflation problem/lesser QE, higher commodity/oil prices and much higher US stock market prices” versus average 10% stock gain by banks.

See below from our 3 Jan 2021 market report (p2,8,9,11):

- “The extension to 150% fibonacci target of 4244 and 161.8% at 4404 is plausible if all the right things fall into place in the new Biden Administration, 100day plan of 100mil vaccinations, fiscal and infrastructure plan and more stimulus to support Americans and small businesses. The upside of 10% is the consensus view of most investment banks.

- The problem lies in the degree of inflation expectations, US-China rivalry, Iran, Fed policy of lesser QE and even earlier tightening and concerns of Biden's tax plan in 2022 onwards. Something to watch out for.

- The key thing to watch in 2021 is inflation and potentially rising rates, both a risk-off for stocks.

- Recently, there have been talks of rising crude oil prices due to Covid19 vaccines making it possible for economies to revert to old norms by mid 2021.

- Crude oil 3 year chart: bullish oil trend to test $60 as vaccines would make travel and reopening of most countries an earlier than later reality from June 2021.

- Also, calls for stronger dollar to a new Janet Yellen Treasury has grown and that could mean letting rates rise earlier as inflow of demand tend to keep rates rising as a tighter monetary policy may be used as vaccines reduce the need for more expansionary monetary policy and even QE.

- The need to scale back the Fed's balance sheet as it did prior to the coronavirus appeared in Jan 2020 may be the playbook as top think tank fear the devaluation of the US dollar if rising debt levels are not backed by economic growth and fiscal discipline.”

Recently, we were wrong on the magnitude of the stock market correction in the past few months of 10% as it was only -6.3% for S&P 500 index and for Nasdaq index -9%. But we were not wrong to be cautious when capital preservation is the basic goal of all investors before capital gains. As Rudyard Kipling once wrote: “If you can meet with Triumph and Disaster and treat those two impostors just the same...”

Commodities and oil in general are trending higher and it can have a slight correction but the path of least resistance is higher. With crude oil at $80, what's next? Depending on the supply side which is quite constant while the demand side is still rising due to ultra-large fiscal stimulus last year.

The oil price high in 2009 at $150 may be distant but not impossible, though the probable target zone is $90 - $105 in coming months; though a correction is probable once $90+ reached. Some experts dismissed 1970s stagflation but this may be a cost-push inflation. The situation does not look 'transitory' as some US central bank officials have now walked back slightly from the earlier views as the Fed taper was announced on Nov 3. (we had learnt long ago from legendary trader Paul Tudor Jones to not trade before a big event and this week we had Fed monetary policy meeting that was a game-changer and US Non-farm payrolls)

Both supply chain shocks and demand for raw materials are driving up prices of shipping and result in higher costs that in turn result in higher inflation and spiral to higher energy prices. The retail side may get into commodities and result in higher prices as the fear of supply shortages may lead to a 'stockpiling mentality'. The supply-chain crunch for semi-conductors and logistics overhang are not going away for another 6-18 months as TSMC the largest wafer fab producer would only have a new US factory in Arizona in 2024.

The reflexive nature of oil, soft commodities, grains and livestock is feeding a positive feedback loop that distort the mentality of market participants, fundamentals of production and lead to higher prices. The end is not near at the moment given that oil, food and housing prices are still surging.

As a global macro/multi-strategy fund, 'dynamic asset allocation' to other asset classes helps reduce risks and hedging using put options is one of the effective tools besides short-selling stock index futures, SPY ETF index and selective weak single stocks. The failure to diversify to other asset classes is a classic issue for investors. The complacency that 'business as usual' for equity markets is typically why losses mount for funds and retail investors. A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the high market prices and risks.

Our Jan 2021 market report, p3 as below highlighted the risks of 'Stay home or WFH-work from home' stocks:

- Our last month's report we wrote on 'stay home' stocks like Zoom's weak trend: 'By that we can say the Covid19 stocks that rallied sharply this year could be due for a normalization once the vaccine is deployed in 2021 in large scale. Their lofty valuations fuel by fear and speculation would come to earth as their business usage would likely be affected if international travel picks up. Names like Zoom, Docusign,Clorox,Teladoc.”

Year-to-date, YTD their stock prices: Zoom -16.3%, Clorox -18.5%, Teladoc -24.9% except Docusign +27.8%. If we include one of our portfolio hedge (short-sell idea) Peloton is down -43.2% for 2021.

Inflation rates in Europe were 4.1% in October and not far from the US raging 5%. There may be a natural reflex to look for cheaper deals or reduce spending and we must be aware of companies with less strong financial cashflow, reserves and brand equity to keep their sales high. We hold a bullish view on most commodities except for Gold and other industrial metals as a way to diversify risks and food and energy are 2 basic goods that the world cannot do without.

The US Dollar could be in the early stages of a rally as tapering could be faster than expected to counter inflation and rising energy costs. The Fed tapering of US$15bil a month would end by mid 2022 and Powell has said it is too early to talk about rate hikes until full employment is achieved. The US labor report, Non-farm payrolls at 531k vs expected 425k jobs for Oct and unemployment at 4.6% vs 4.6% was not bad though corporate earnings are likely firm as technology has helped companies stay competitive globally.

However, CME FedWatch Tool futures indicate: 43% probability of an interest rate hike in June 2022 meeting with target rates at 25-50bps, 19% chance at 50-75bpts by July 2022, 29% chance at 50-75bpts by Sep 2022 and by Dec 2022, 21% chance that Fed Fund rate is 75-100bpts. 2022 will not be an easy year.

The goal to have full employment and 2% inflation rate sustained over a few quarters may be sufficient for some action by Fed especially if the business community voices concerns of spiralling costs of raw materials, logistics and wages (A side risk factor is the re-nomination of Fed chair Jerome Powell by Feb 2022, a different person could alter the decision making process)

Bitcoin rose back above $60,000 to new highs as we knew the alternate scenario if the support level of $35,000 was held. The China and India ban on crypto is not a concern for most investors as they move offshore. Only astute traders may be able to trade in highly volatile 2 way markets.

Risk-reward ratio for US S&P 500 is not great as potential upside at 4689/4845 & downside at 4210 – 3980. Potential 5% gain with potential 9-14% loss.

The key support levels: 4539 & 4210 (200 DMA). The bias is to go higher now to 4689 & 4845 (despite the risks) and we have hedges for downside risks till a “larger jump in inflation, worsening Covid19 death rates or worsening corporate earnings”. 70% of US S&P 500 stocks are >20DMA & 200DMA – strong buying power of large investors & corporate insiders.

The new Biden Covid vaccine mandate that requires companies with 100 or more employees to ensure their workers are fully vaccinated by Jan 4, 2022 is a positive step to reduce the pandemic's risk of spreading. That would aid the re-opening - great for the economy, firms and consumers.

1 Oct 2021 market newsletter – ‘Play the ball as it lies.’

'Golf is the closest to the game we call life. Your get bad breaks from good shots; you get good breaks from bad shots – but you have to play the ball where it lies.'

Bobby Jones, 1902 – 1971 winner of 9 majors

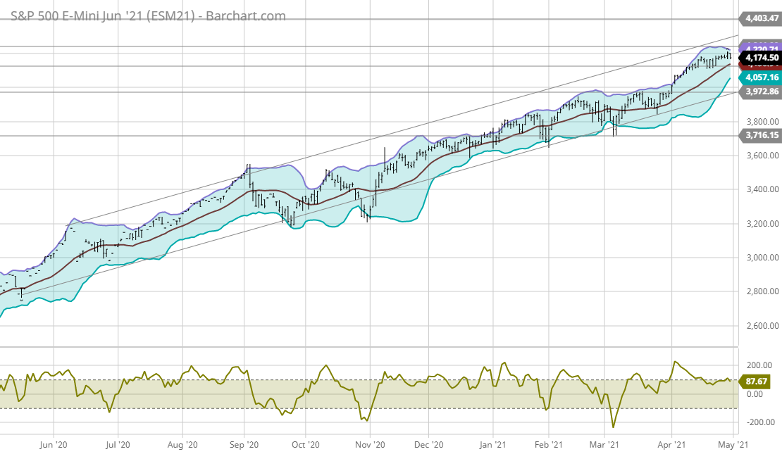

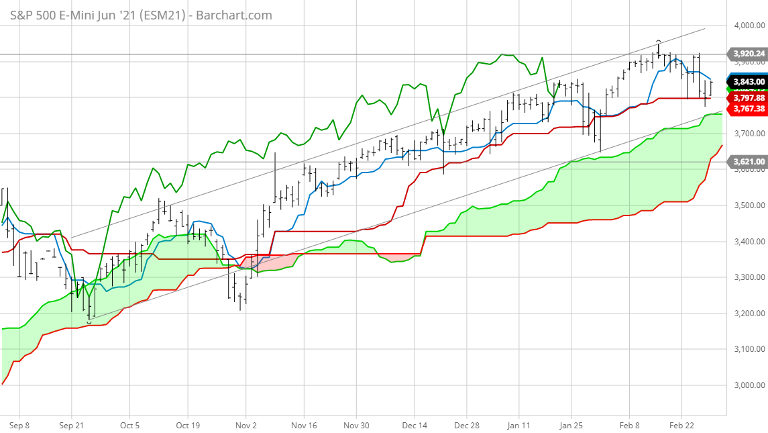

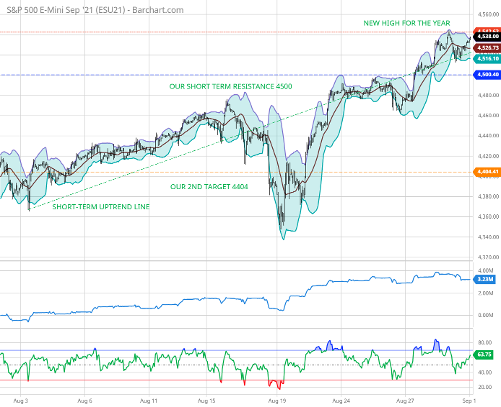

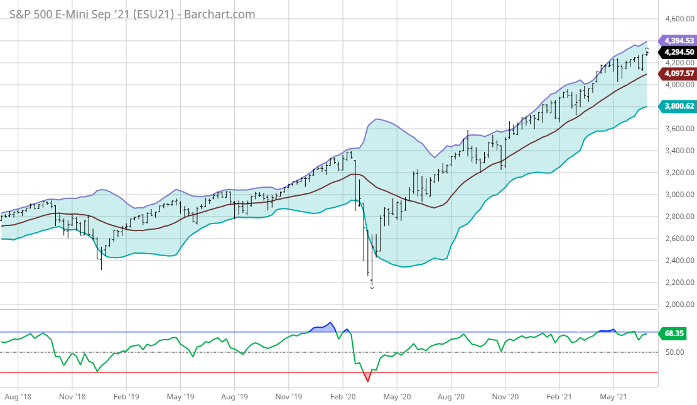

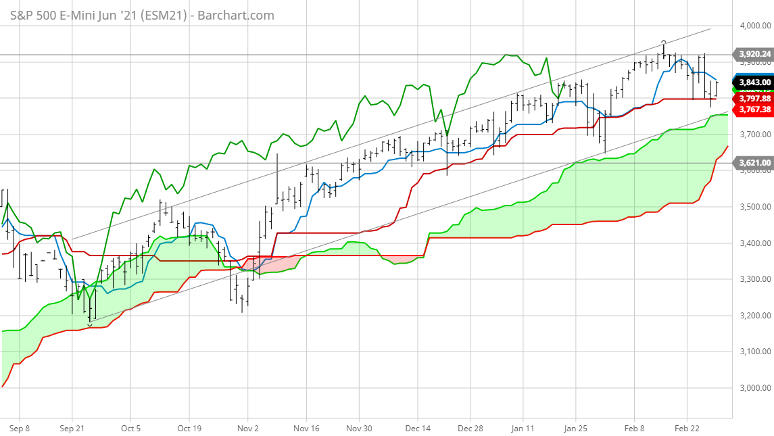

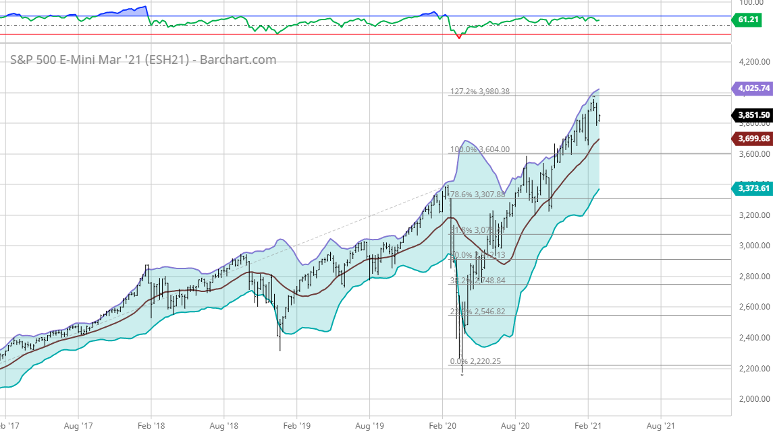

U.S S&P 500 index futures chart as at 31 Sep 2021:

The meaning of the quote above can be interpreted as learning to adapt to overcome uncertain situations and not blame others or find excuses. Financial markets is very similar as unknown risks can catch one off balance and it is imperative to 'anticipate and be prepared' when such events occur.

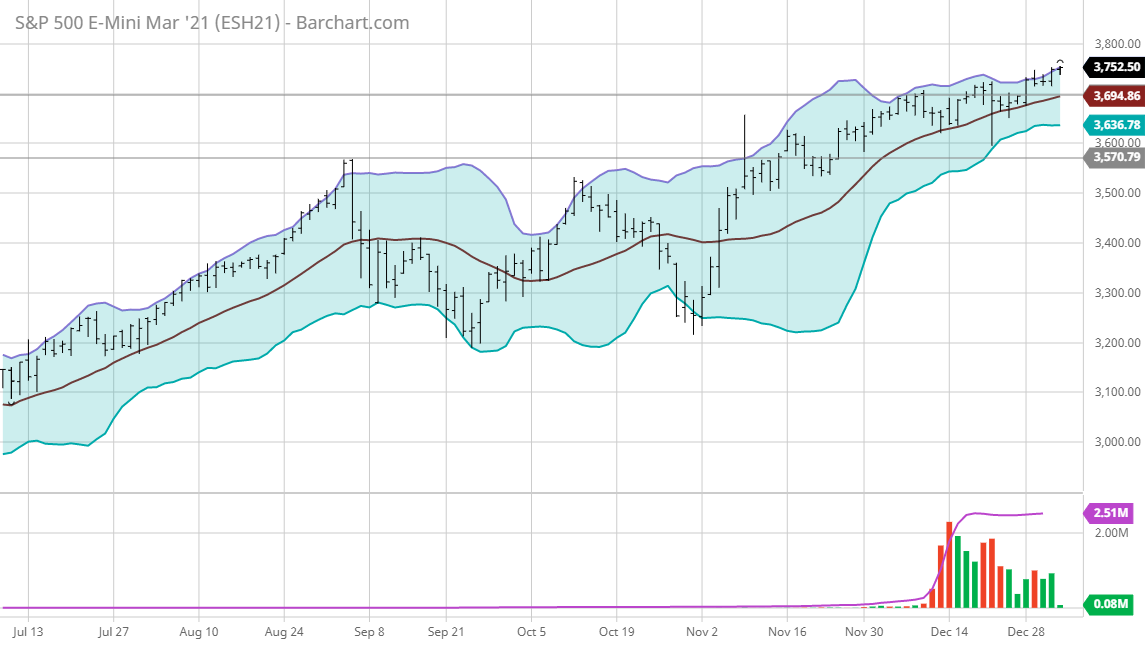

- Stock rally of the last few months saw a glimpse of more serious trouble after the US S&P 500 stock index futures rose to new high of 4545 exceeding our 4500 upside target by 1% and then reversed down to break through all the support levels at 4450, 4404 & 4396.

- The notion that higher inflation would fade any time soon is just a perception of those uber bullish investors or sell-side bankers. Federal Reserve Chairman Jerome Powell finally had to say the central banks' inflation targets have been met and a Fed tapering of asset purchases is appropriate. A rate hike expected to be in late 2022 - 2023 may become sooner if inflation is entrenched.

- The losses in September was anticipated by us as we mentioned a 20% gain for US S&P 500 stock index and 19% for Nasdaq index are outliers after last year's 2020 gain of 16% and far exceeded average historical gains. The 2 reasons are outsized stimulus and over-optimism as young traders jump in with both feet using mobile apps with hope.

- The US budget deficit has increased more than all deficits in the last few recessions (1982, 1990s, 2000 dot-com, 2008 GFC) and monetary policy has increased in 3 months in 2020 than the whole of what occured in 2009-18 crisis. No wonder the US stock market has gone parabolic - rising beyond the norms.

- The key support levels are 4244 and 4134 (200 DMA). The trend to go sideways may be short-lived as 'path of least resistance' is lower prices. As a global macro/multi-strategy fund, 'dynamic asset allocation' to other asset classes helps reduce risks and hedging using put options is one of the effective tools besides short-selling stock index futures, SPY ETF index and selective weak single stocks.

- Both US and European inflation rates have accelerated to new decades highs. Eurozone rose to 3.4% a record 13 year high and US index at 4.2% for July and core price index (excluding food & energy) rose to 3.6%. It is natural instinct to reduce spending. As such, we remain bullish on most commodities except for Gold and other industrial metals.

- The rise in vaccinations globally is a positive sign that Covid may be at least under control for now. Booster shots for elderly will gain traction in Q4 2021 - Q1 2022 and that could setup a bullish trend after a correction in Sep-Oct.

- It is a rule for us to be - early buyers in a trend but also recognize when the trend is maturing. The 'competitive edge and margin of safety' are 2 underrated notions. It is vital to take profits or cut losses early and not be 'married to the bull or bear side'.

- We are turning bearish Nasdaq as technology stocks will be hit by supply chain issues and revenues delayed in coming quarter at least. The serious technical breakdown of Nasdaq 100 below key support levels made it imperative for professional traders to cut losses. The other reason being 're-opening of travel' by Jan 2022 is highly possible.

- The failure to diversify to other asset classes is a classic issue for investors. The complacency that 'business as usual' for equity markets is typically why losses mount for funds and retail investors. A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the high market prices and risks.

- Over-concentrated portfolios of single/social media/gaming stocks is to be avoided as no one knows exactly when regulation comes or when a new disruptive technology erodes the incumbent's market share. The recent Archegos Capital bust with $50bil of levered bets on a few US and China stocks.

- The US Dollar rise has been forward looking to eventual rate hikes. The US dollar bears are in for a surprise as Treasury chief Yellen and Warren Buffett proposed no debt limits in future.

- Bitcoin corrected to below $50,000 as China ban all cryptocurrencies that would make nervous investors either to take profits or cut losses (some may attempt to move offshore). A retest of $38,000 support level is possible. How the rest of the world, especially the U.S intends to regulate Bitcoin would be hard to predict and may be a 'black swan' risk event. Only astute traders may be able to gain in downtrends.

- Risk-reward ratio for US S&P 500 is bad with potential upside at 4600 & downside at 4134 - 3980.

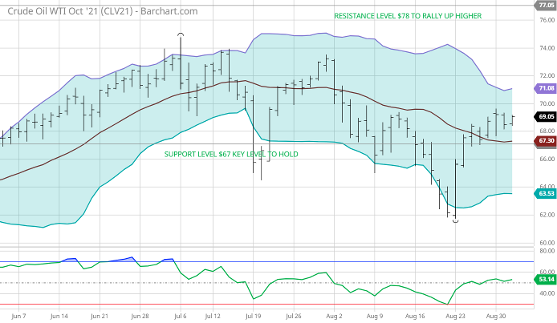

- Oil prices rose to $74 and is testing the resistance of $78 en-route to $80> oil. Some experts dismissed 1970s stagflation but it could be just a cost-push inflation.

- A 10%> correction is likely despite the recent revision of US Q2 GDP to 6.7%.

Our Sep market report also stated the need for portfolio hedges:

“ZM and PTON opened with stops last month, we are closing them and initiate a new short on Newmont Mining, NEM - typically gold price rally up and then trade sideways do not bode well for miners.”

Newmont Mining, NEM: stock price fell 14% for the month (chart below)

Our Sep market report on bearish US stock markets especially Nasdaq 100 stock index (chart below):

“The breakout could be a false break as the Fed tapering of its $120bil asset purchase per month is unlikely to reverse – it's a question of when not if.”

Also, our Sep report on rising rate expectations and bearish bond trend (chart above):

“30 year US Treasury bond yield went to low of 1% and 10 year US Treasury yields to 1.2%. and reversed up. Bonds are overvalued versus inflation and stock dividend yields relative to historical norms.”

1 Sep 2021 market newsletter – ‘Imagine.’

'And the world will live as one.'

song by John Lennon

The famous 'Imagine' song with its 50th anniversary on Sep 9 by ex-Beatles leader is apt to remind us we should strive for peace. The inspiring song is idealistic as 'possessions and power' cannot be easily given up. The chaos in Afghanistan highlights how a situation can turn bad very fast if preparations are not done adequately. The same goes for financial markets as most bullish investors would 'imagine' or assume good times keep rolling on and influenced by media – social and conventional.

- Rally continues despite higher inflation and almost all global equity indices rose in August. Dow Jones Global index gained 16% for 2021. The US S&P 500 stock index futures rose to new high of 4537 exceeding our 4500 upside target by 0.8%.

- The US budget deficit has increased more than all deficits in the last few recessions (1982, 1990s, 2000 dot-com, 2008 GFC) and monetary policy has increased in 3 months in 2020 than the whole of what occurred in 2009-18 crisis. No wonder the US stock market has gone parabolic - rising beyond the norms.

- The gains for the year has finally hit 20% for US S&P 500 index and for the Nasdaq 19%. It has exceeded past average gains and could be due to over-optimism and new 'Reddit' traders jumping on board.

- The key support levels are 4450, 4396 (50 DMA) and 4255 previous resistance level. The trend may go sideways to higher for some time but hedging using put options may be a tool to hedge as markets are 'never linear'.

- Price surging due to supply chain disruptions and strong demand has inflation rising to almost 30 year highs – Fed's preferred measure the PCE index at 4.2% for July and core price index (excluding food & energy) rose to 3.6%. It is natural instinct to reduce spending when prices rise faster than our wages.

- The rise in Covid Delta variant cases and more deadly variants have to be taken seriously. Some investors have forgotten a pandemic is still ongoing – but 'over-loved' Covid stocks like Zoom & Peloton fell 12% & 34% this year.

- We believe it is better to be - early buyers in a trend but also recognize when the trend is maturing. The 'competitive edge and margin of safety' are 2 underrated notions for investing in today's digital world.

- We are staying neutral on Nasdaq as technology stocks still have poor risk-reward ratios and history has shown a correction for Nasdaq tends to be the norm. As Karl Popper said: 'No number of sightings of white swans can prove the theory all swans are white. The sighting of one black swan will disprove it.'

- Another misconception and underrated notion of investing is diversification. Many think that they they will make less money and can put 'all their eggs in one basket and watch that basket closely' like some famed investors.

- For most, it is prudent to diversify to other sectors/asset classes as it is a proven strategy even for professional global macro investors. The risk of over-concentrated portfolios of single stocks/social media stocks/gaming stocks is to be avoided as no one knows when regulation comes or when a new disruptive technology erodes the incumbent's market share. It is vital to take profits or cut losses early and not be 'married to the bull or bear side' especially due to behavioral biases. The recent Archegos Capital collapse comes to mind (with $50bil of levered bets on a few US and China stocks).

- A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the high market prices and risks. We remain bullish on most commodities despite prices hit our short-term targets (refer to Cross-Asset Class section).

- The US Dollar defies the Fed's dovish stance and concerns of budget deficits. It will need more QE to restart the dollar descent not delay of Fed tapering. The US withdrawal of troops from Afghanistan would save billions for the US and that can help reduce the bloated budget deficit.

- Bitcoin rose higher to almost $49,000 after testing $35,000 support level. The challenge is how crypto can be adopted by central banks going forward not the perception of investors only. Only astute traders may be able to gain in fast moving markets.

- Risk-reward ratio for US S&P 500 is bad with potential upside at 4600 & downside at 3980: 1.7% gain vs 13.6% loss or $1 gain for a loss of $8.

- Oil prices held support of $67 and could rally higher to above $76 on more tropical storms and potential middle-east tensions. Stagflation scenario in 2022 is a worst case scenario.

- Fed chairman Powell's dovish testimony at recent Jackson Hole Symposium online resulted in a market rally yet the taper is inevitable by year end. The fact is an overheated market would cool off at some point – caveat emptor.

- A 10% correction is not too hard given the gains this year of 20%. A cooling off for the markets would keep confidence for the rally to continue in 2022 and show that central bank integrity and judgement is not far off even for a policy change.

- The way of the markets has always been 3 steps forward and 1 step back as market psychology tends to go to extremes while innovation, GDP and earnings tend to be slower. The trendline break every 3-4 years is a typical self-renewing process. The stock rally in last 5 years is phenomenal as 2020 gains in 1 year is equal to the gains made from 2016-2020 of 4 years.

- The chart above sums up 2 decades of market trend. From Internet to mobile era and crypto/digital assets. The crux of issue is income generation for the average worker may lag the superb run up in equity prices and valuations of technology companies in the last 20 years.

- Current market valuations versus the Fed's balance sheet of U$8tril out of synch as the Shiller PE ratio is now at 35 and getting close to 44, the 2000 highs - 2nd highest in the last 100 years. Clearly the E – earnings is not rising fast enough vs stock prices.

- It is in the interest of the Fed and Powell to ensure US maintains full employment and price stability but also the 'wealth effect' and 'competitiveness of US corporations' by delaying any Fed tapering but the consequences are rising inflation and asset bubbles.

- US GDP comes from 70% consumption and the stimulus has driven consumption in the last year with Q2 growth slowing. Real economy is driven by production. The chip shortage and logistics bottleneck drive up prices - a dichotomy. Some call it a 'market anomaly' presenting opportunities for astute traders/hedge funds to take advantage.

- Commodities have done very well this year and after hitting new highs in June, a sideways trend or minor correction occurred. The inflation – commodity correlation has strong empirical relationships and that bodes well for CTA (Commodity Trading Advisers) Funds and producers of commodities.

Our Aug market report on Commodity, wheat, sugar and oil bullish trend continuation: “Wheat Futures Sep '21 – selloff to 614 and reverse up as the bullish breakout is in early stages of a long trend”; “Sugar futures Oct '21 – bullish breakout trend intermediate stage, price fell to 16.80 and reverse to 18.77; our target at 20.93 (high in 2017); frost and drought issues in Brazil would likely cut production”; Oil Futures Sep '21 – trading at $70 after testing $67 support to low of 64.85; $80-85 is probable if supply tightens and U.S infrastructure deal get passed, support at 67 and resistance at 78

Re-opening trades / Sector rotation trades: Macy's stock has done very well as we had anticipated the re-opening since Jan 2021 at $11.25 and has risen 99% year-to-date. Given the resurgence of Covid Delta variant – we are cautious now but stay bullish as it is still below the 5 year high at $40.

Being FLUID – Vigilance and changing to suit the conditions as facts change: We wrote last month of the bearish trend of China big technology stocks like Alibaba & Baidu. There is reason to believe the selloff is near its end after 6 months and may turnaround. But, upside could be there over an adjustment period to new regulations in sideways move. Precise entry levels needed.

- Active investors need to step up with ESG investing to help save the planet: The climate change movement is moving ahead despite valuations concern. US rejoins the Paris Climate Agreement and Biden's new infrastructure deal make it imperative to own some ESG type stocks or assets – but being selective and tactical in timing is crucial. Obviously, there are risks to ESG investments like EV or other renewable technologies. As we seen EV stocks like Nikola where the ex-CEO is being charged by SEC and Workhorse Group as both stocks loss 31% and 50% respectively.

- A rotation to Solar, Wind and Vegan-meat companies: The EV story is still strong with tremendous growth in coming years but it is fair to say we need to look at other options and wait for better price levels to get in again. NextEra Energy, NEE, Vestas, VWS, Avangrid, AGR and Beyond Meat, BYND are possible alternatives to the high flying EV stocks like NIO, Tesla and Xpeng.

3 Aug 2021 market newsletter – ‘Be water.’

- The S&P 500 stock index futures hit a new high of 4422.50 on 29 July, exceeding our 4404 target (set in Jan 2021 report) by 0.4%. So did Dow index made a new high at the month end at 35082 and the Nasdaq 100 index.

- VIX or 'Fear' index low was at 14.6, not 13.29 as we expected as in 2006, 2014 and 2018, key levels tested before any reversal in volatility. The push higher to 4500 for S&P 500 index is not impossible as capital flows out of China stocks & cryptocurrencies on further regulatory risks could benefit US stocks.

- The key support levels are 4321 mid-point from high and low, 4255 previous resistance level and 4292 (50 day moving average). The trend is likely to go sideways for some time. Hedging using put options may be viable.

- Inflation rate rose to 13 year highs as CPI, PCE, home and food prices rose in the U.S. A sharp appreciation in prices could take the markets and Fed by surprise by year end especially with erratic weather due to climate change. Recent surveys show that about 86% of consumers reduce spending due to higher inflation. (PCE Chart above from St Louis Fed)

- The Covid Delta variant cases rising globally is a major concern as the variant is now present in 132 countries. China also reported more than 320 cases in 15 cities like Beijing, Hunan, Henan, Hainan, Hubei and Nanjing (source: Global Times). In the US, recent CDC data showed a rise above last summer's peak of average daily cases, 72,790 cases. The big risk is China and US: An outbreak that goes exponentially will result in lockdowns and a sudden 'risk-off' event.

- At 4422 level, gains for the year would be near 18%, way above the historical norm and even better than 2020's gain of 16% due to large fiscal and monetary stimulus and vaccine discoveries. Most stocks rose due to over-optimism.

- The competitive edge is not distinct and we rather use the high prices to take profit - be early buyers in a trend but also recognize when the trend is maturing. The future growth and 'margin of safety' is vital with high prices.

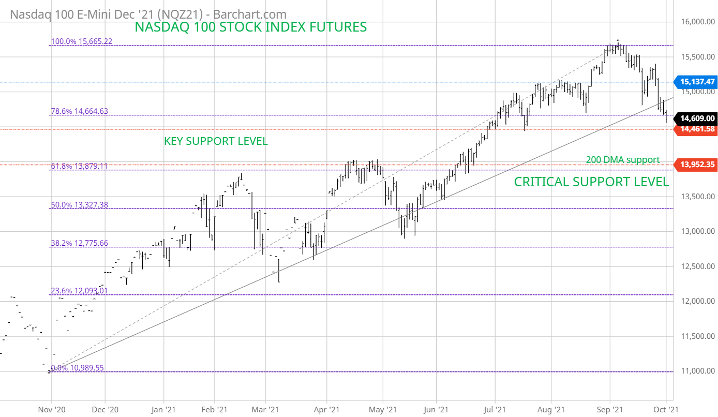

- The Nasdaq 100 index hit 15134 and exceeded our target of 14,400 levels by 5% (a 2x extension of the move from 2018 to Feb 2020). It's a large move since 2018 at about 6000 points. A rise of 152% in 2 over years. For now, we are staying neutral on NASDAQ as most technology stocks have unattractive risk-reward ratios. A correction for NASDAQ to 13,600 - 12,500 can't be ruled out.

- Diversification to other sectors/asset classes should be continued. Too many investors are taking too much risk by holding too many single stocks/social media driven stocks like GameStop, AMC etc. Failure to take profits or cut losses early would have bad outcomes as 'anchoring' on the bull side take hold.

- A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the high market prices and risks. We remain bullish on most commodities despite prices hit our short-term targets (refer to Cross-Asset Class section).

- A reversal of US Dollar despite Fed's dovish stance as interest rate expectations for hikes in 2023 are rising. Bond markets stay grounded to low yields on Fed non-action – bond investors 'conditioned' since 2010 QE.

- Bitcoin stayed range bound between $30-40k as new regulations from China to U.S could impede investor's confidence. The 20k level is probably a better level for traders to buy. The climate is more challenging yet more institutional investors are bullish cryptocurrencies for 'fear of missing out'.

- The risk-reward ratio for the S&P 500 is not good with potential upside at 4500 and downside at 3980 for a 2.2% upside vs a 14% downside for a 0.17-1 ratio.

- Oil prices fell to test our support of $67 and bounced to $70. The growth rate may worsen due to Delta variant and rising oil prices - a stagflation scenario.

- The rally can be revived after a meaningful 10% correction due to new stimulus by central banks; but will the rally exceed the high prices of the year?

1 July 2021 market newsletter – ‘Going to extremes is never best.’

- The S&P 500 stock index hit a new high of 4302 on 30 June, exceeding our 4244 target by 1.3%. Dow index could not surpass the last high of 35091 as traders bought back into the technology sector.

- The markets do not go according to plan most of the time and we have to expect the unexpected. The key support level is at 4203 (50 day moving average). The trend is likely to go higher as the breakout of 4250 towards our year end target of 4404 (161.8% Fibonacci target). We were wrong to think that a correction would occur after our short-term target 4244 was achieved even when inflation data rose (see below chart) and oil prices went above $70. It could either miss 4404 or break higher than that

- Whatever the case, it is the 'actions backed by sound decision-making that matters, not talk'. At 4400 level, gains for the year would be 18%, perhaps as good as it gets (above the historical norm); better than 2020's gain of 16%. From our perspective, the investing edge becomes less sharp and would use the high prices to take profit as it is vital to be early buyers in a trend and riding it but also recognize when the trend is maturing. The price we pay for an asset with its potential growth is critical and 'margin of safety' must be factored in.

- The Nasdaq 100 index hit 14503 and exceeded our target 14,400 level by 0.7% (a 2x extension of the move from 2018 to Feb 2020). It would seem to be a watershed point as 2018, Nasdaq 100 in Dec 2018 was at about 6000 points. It is a significant move in 2 & 1/2 years. At this moment, we are staying neutral on Nasdaq and most tech stocks as the risk-reward ratio is less attractive now.

- A deeper correction for Nasdaq to 13,600 - 12,500 cannot be ruled out in coming months. As most technology stocks have mostly become less attractive on a valuation basis given the growth projections. Even a sports car in the Le Mans race need to stop to rest. Most economic data have reached new highs – GDP, ISM, employment and inflation. It is best to recall Lao Tzu's quote: 'If he don't take sides, he don't lose a battle.'

- The upcoming US Non-farm payrolls on July 2 could give another push for 'risk-on' as 690,000 jobs are expected to be created and a lower 5.7% unemployment. EV leader Tesla didn't perform well while competitors GM and Ford started rising with their new EV models. Airline stocks and Boeing should stay firm as travel resumes. ESG stocks like BYND or solar stocks may offer more value than EV stocks now. Utilities and consumer durables are other viable options besides energy sector.

- Constant observation and diversification to other sectors and asset classes in the last few months should be continued. The herd mentality of 'Work from Home' and retail traders via Robin Hood have gone all-in. Contrarian thinking puts us in situation to examine if our edge exists and to exercise patience. Behavioral finance experts would say most investors are now anchored or 'programmed' to look mostly on the bull side.

- A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the current market level and associated risks. 2021 has seen over speculation in cryptocurrencies and single stock names that raised investor complacency. FX markets see a reversal of US Dollar post FOMC meeting as interest rate expectations for hikes in 2022-2023 are rising.

- Bitcoin had a bad month as it broke below $30,000 briefly before rising back to $36,000. The trend looks weak despite the attempt by bullish traders to talk it up. China had started to ban Bitcoin mining. After missing our earlier target of $70-72k, potentially a fall to $20k level could be a good buying opportunity for those looking to diversify from gold & cash. The latest large institutional investor to join the Bitcoin trading arena is Soros Fund Management, an astute trader in both directions of an asset class.

- The U.S corporate earnings season start in July. Any divergence from the market leaders could be a signal the S&P 500 have a hard time advancing and due for a pullback of up to 10%. Rising oil prices above $74 (our intermediate target) to $80 and Bitcoin falling below $30,000 could result in a 'risk-off' event selloff. Longer-term the rally could regain again due to the unprecedented stimulus by central banks globally and large fiscal policies. It is impossible to make predictions but at best anticipate.

- Our June market report also stated the need for portfolio hedges:

- 'Some hedges or bearish short-sell potential: Docusign, DOCU, Peloton, PTON, Zoom, ZM, EDU + LVS:

- For this month, we are adding Las Vegas Sands due Covid19 effects on its Asian operations after selling its Vegas business.'

- See below 6 month chart below of Las Vegas Sands, LVS stock price fell about 5.9% in June; continuation of the downtrend from March 15 high of around $66. The next level of support appears to be at $48 and a place to lock in profits.

1 June 2021 market newsletter – ‘Here comes the Sun.’

- Last month, most US big cap market leader technology stocks traded lower except for Alphabet & Facebook. EV leader Tesla didn't perform so well while competitors GM and Ford started rising with their new EV strategies and models. Airline stocks and Boeing continue to rise as UK-US travel may re-open soon.

- The S&P 500 stock index hit a new high of 4238 on 7 May, just missing our mid-term target of 4244 by 0.14%. Dow and Nasdaq indices were near to previous highs but could not surpass it. The divergence could be a signal the the S&P 500 may had faced a strong resistance and due for a pullback. The rise of oil prices above $70 and Bitcoin falling further may spark a selloff in the near-term.

- The key support level at 4050 and 4250 resistance are key. The trend is losing some momentum as our mid term target at 4404 (161.8% Fibonacci target) may be a markup for the year end. Summer months of re-opening may not be as smooth as planned and institutional investors would hedge by selling futures. A selloff to 3972 critical support is not unlikely as it would be 6.3% correction from recent high. A 10% correction to 3850 from 4250 would in past market history nothing shocking. The strong markets in a pandemic may have rewired most traders to look on the bull side mostly. The tech market leaders of this rally need to resume higher to give confidence to the overall equity markets. It is impossible to make predictions but at best anticipate.

- The path of least resistance though is higher in the near-term but we are vigilant for a risk-event to spark profit-taking. Any sports car that runs non-stop needs to rest even Le Mans car race is for 24 hours only – thus, a 10% correction in a bull market is normal and even healthy and good opportunity to buy.

- Potentially, the Nasdaq 100 index upside may rise to 14,400 level target (a 2x extension of the move from 2018 to Feb 2020. Though a deeper correction to 13,080 - 12,500 may occur as most technology stocks had rallied hard in 2020 and became overvalued, misled by herd mentality of 'Work from Home' as the new normal.

- The inflation fears are not going away and spark a capital shift if oil prices crosses $70-80 and 10 year bond yield shift a notch higher to 2%. Bond and FX markets are on the same side as Equity traders these time believing that low interest rates are staying for longer. Time will tell.

- Too many investors are still in the era of 'Work from Home' and hold large chunks of stocks that carry much risk. A portfolio of high quality equity, bonds, currencies and commodities would be more resilient given the market risks as over speculation in cryptocurrencies and single stock names have raised complacency. We remain bullish commodities but prices are near our short-term targets (refer to Cross-Asset Class section).

- Bitcoin rise to $65,000 high miss our intermediate target zone of $70,000 - 72,000 levels and the sharp correction below $40k support level shows that insiders are taking profit while new 'believers' are jumping in buying on dips. This selling in BTC could partially explain gold prices rise. Typical behavioral patterns of a bubble market. We could be wrong as BTC has little fundamentals to study as the buyers may jump in again.

- Our May market report also stated the need for portfolio hedges:

“Some hedges or bearish short-sell potential: Docusign, DOCU and Peloton, PTON, Zoom, ZM + EDU”. We are adding New Oriental Education & Technology, EDU as a new short-sell hedge as China regulation clamp down on online education firms. Also, talks of inflated sales numbers on EDU quite similar to crash of Luckin Coffee's in 2020.

See below 3 month chart of New Oriental Education & Technology, EDU stock price fell about 32% in May:

Cross-Asset class diversification

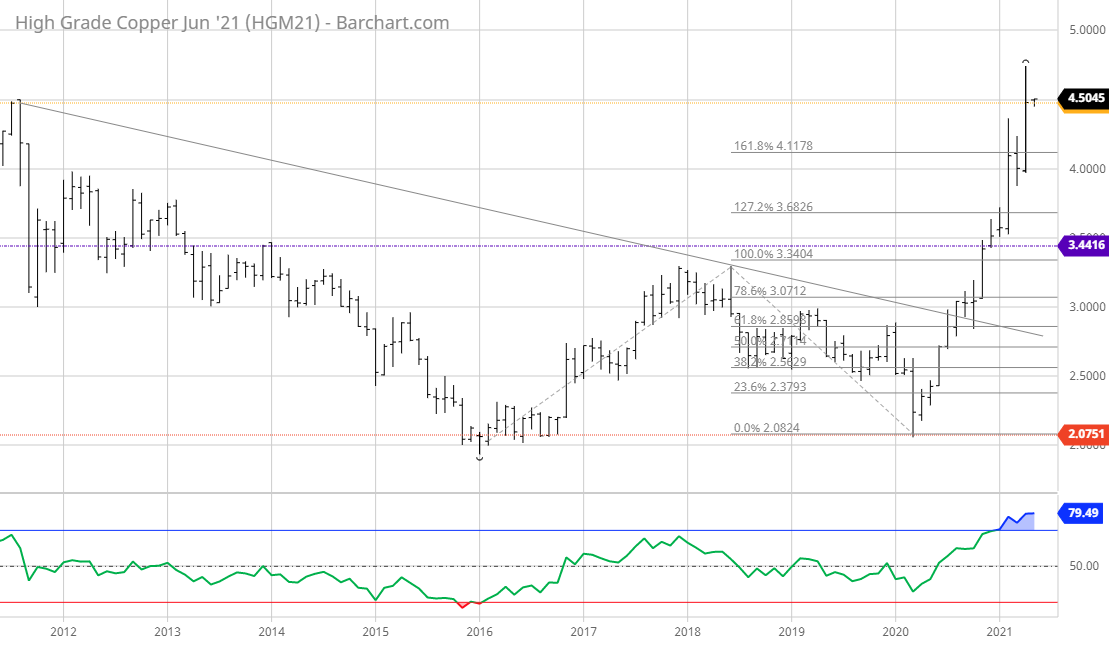

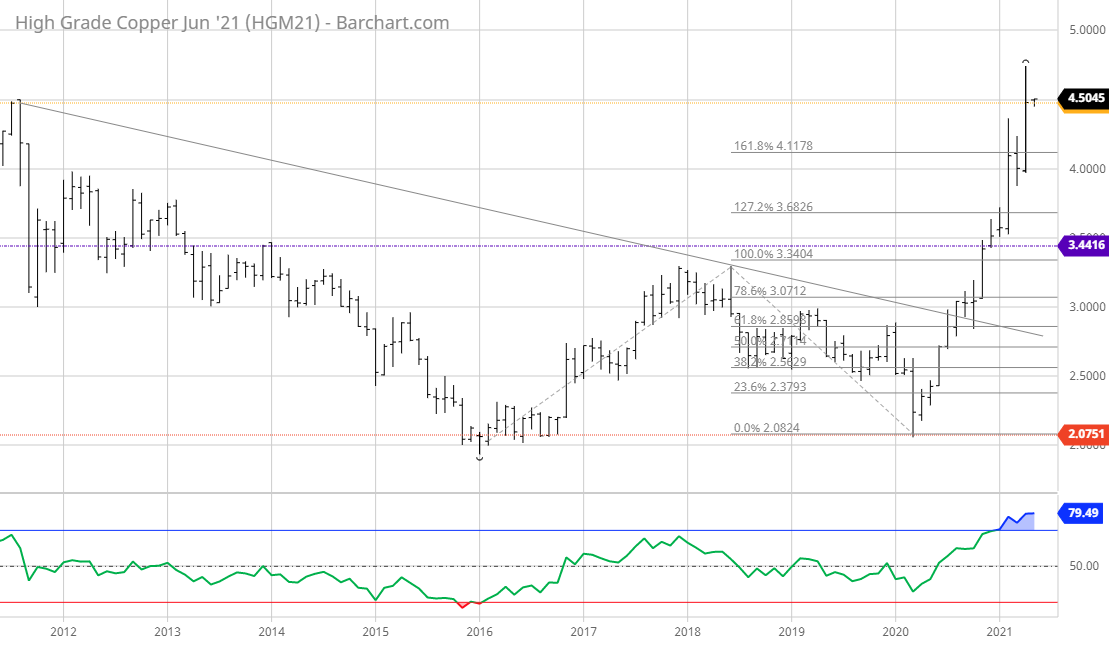

Copper chart below last month with our expected target of '10 year high at 4.50' (indicated in yellow dotted line) which had been exceeded by early May and now trades at 4.65:

3 May 2021 market newsletter – ‘Our knowledge can only be finite.’

'Our knowledge can only be finite, while our ignorance must necessarily be infinite.'

Karl Popper

- Last month, we said US big technology stocks like Apple, Amazon, Microsoft, Alphabet & Facebook need to join the rally of US equity markets. Their strong earnings helped S&P 500 index reached new highs, 4218 on Apr 29.

- Thus, stocks like Caterpillar, Southwest Airlines, Starbucks, Bank of America, Blackstone, Ralph Lauren and Visa are some top gainers in April in the reflation theme, whereas many SAH,'Stay at Home' or WFH,'Work from Home' stocks like Zoom, Peloton, Teladoc, Shopify, Grubhub, Spotify, Zillow etc are off its highs.

- 4050 level will be a key support level and 4250 resistance. The trend is losing some momentum as 4244 target level is pivotal to turn US equity index strongly positive, en-route to 4404 (161.8% Fibonacci target). It may not be linear as most of the good news have been reported and a selloff to 3972 critical support may occur.

- The path of least resistance though is higher and 4244 levels is highly probable even if a subsequent selloff occurs. A decent correction to next level of support at 3790 likely find value investors looking to buy. The facts are what matters - the underlying economic conditions and how it evolves. A 10% correction in a bull market is normal and even healthy. It is unlikely a major acceleration of Covid19 infections and deaths globally.

- We mentioned earlier a strong catalyst is needed to push equity prices higher. It could come from a few possibilities: full re-opening of US economy, weak form 'herd immunity' with 70% population vaccinated, new technological discovery, big improvement in US-China relations. (On the downside, any bad news on Covid19 in US & globally that result in lockdowns will be bad. Military conflicts would also be bad as it will drain resources from ending the Covid pandemic and worst, spur oil prices and inflation higher.)

- Potentially, the Nasdaq 100 index upside may rise to 14,400 level target (a 2x extension of the move from 2018 to Feb 2020. Though a deeper correction to 13,080 - 12,500 may occur as most technology stocks had rallied hard in 2020 and became overvalued misled by herd mentality of 'Work from Home' as the new normal.

- The inflation narrative that plagued the market in Feb could spike once oil crosses $70-80 and central banks may need to adjust their monetary policies. The key level would be 2%> for U.S 10 year bond yield as an event catalyst to dampen investor sentiment and cause a serious reallocation to safer assets away from stocks. A diversified portfolio of high quality equity, bonds, currencies and commodities would be more resilient but are less common today as speculation in cryptocurrencies and single stock names have raised investor complacency. We are bullish commodities and included more trades in the Cross-Asset Class section.

- Bitcoin could rise to intermediate target of $70,000 - 72,000 levels, and would be an indicator to watch on investor sentiment. A sharp correction of Bitcoin could have some impact on institutions that had invested in Bitcoin in the last 12 months and have negative spillover effects on stock markets.

- Some hedges or bearish short-sell potential: Docusign, DOCU, Peloton, PTON, Zoom, ZM +EDU

Both Docusign and Peloton ended weaker in March but are near 50% half way support for last year's gigantic rally that boosted DOCU 338% and PTON 600%. Zoom Video, ZM rose 590%. We are adding New Oriental Education & Technology, EDU as a new short-sell hedge as China regulation cramp down on online education firms. Also, talks of inflated sales numbers on EDU quite similar to crash of Luckin Coffee's in 2020. Sector rotation to re-opening trades would continue and none of these companies have 'monopoly' power

2 Apr 2021 market newsletter – ‘What is an edge in investing and when do you have it?’

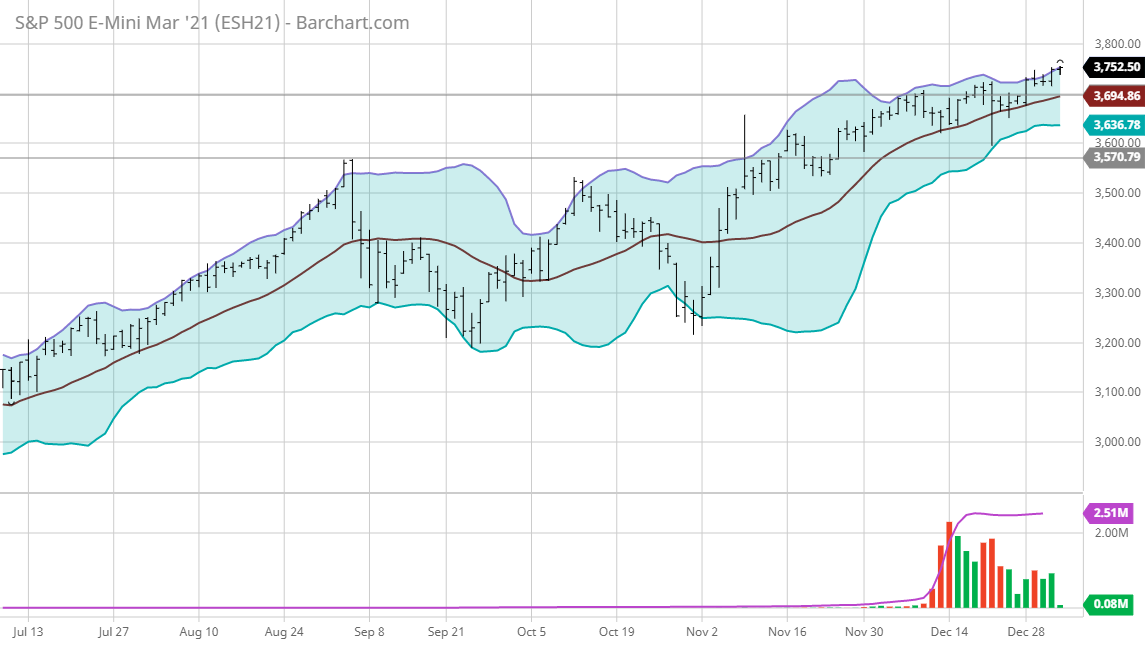

- The ceiling of 4000 seem elusive in March as selling pressure kept trading in the range of 3750 to 3950. On 31st March, news of Biden's infrastructure plan boosted sentiment and index rose to a new high of the year at 3994.21 despite the 10 year Treasury yield holding above 1.7% - breakout had occurred.

- 3850 resistance will now become a key support level for traders while a rise in bond yields and expected inflation may lead to profit-taking. Big Tech stocks like (Google, Apple, Microsoft, Facebook, Amazon) were the last year leaders have to recover to ensure the positive momentum is not a false break. Overall, the index rose higher in March though many prominent stocks are now off their 52 weeks high.

- The path of least resistance though is higher but may need to pause and allow a decent correction to next level of support at 3767 (top of Ichimoku cloud) and 3650 as the 'smart money' may be less eager to buy at the high when inflation is a concern. It is with evidence and facts that must lead us to right path. It is premature to dismiss the bull market even though a 10% correction would actually be a good thing. The trendline from Mar 2020 is intact and no major acceleration of Covid19 infections and deaths are seen compared to last year.

- An interim target zone at 4050-4125 is still viable in the near-term, 4100 lies at the upper trend channel and pullback as oil prices stay elevated and bond yields break above 2%. Though caution is needed with trailing stop loss limits placed. A breakout higher for S&P 500 index to 4180-4400 in coming months is possible at year end but that would be 10% higher and would need a strong catalyst. (Potentially, the Nasdaq 100 index upside may rise to 14,400 level target (a 2x extension of the move from 2018 to Feb 2020. Though a deeper correction to 12,500 may occur as most technology stocks had rallied too hard in 2020 and valuations are too high).

- The inflation narrative that has plagued the market in Feb to March may see a sudden surge again. The key level would be 2% > for US 10 year bond yield to spark an event catalyst and chain event to dampen investor sentiment and cause a reallocation to safer assets rather than stocks. Bitcoin rising to $60,000 may see some flows but it is also over traded and may be find hard to rise above $70,000 - 72,000 level.